Hwange Colliery Company Limited (HCCL) management is reluctant to take a pay cut as directed by Mines and Mining Development minister Walter Chidhakwa and is adamant that the 90-day ultimatum they were given by government to turn the coal miner’s fortunes is not realistic.

CLANTON SIMUCHEMBU

Last month, Chidhakwa ordered management to cut their salaries and benefits by 50% and gave them three months to ramp up output or risk being fired.

But according to minutes of an executive management meeting held on February 3, it was agreed that the ministerial order was not feasible.

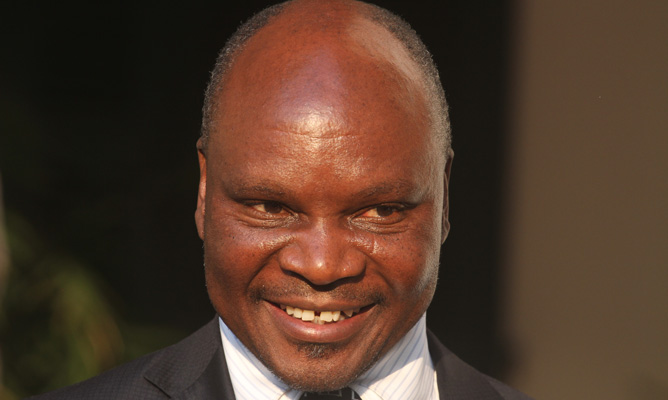

The meeting was chaired by managing director Thomas Makore where it also emerged that the colliery is facing serious viability problems.

“The directive to cut managers’ salaries and allowances by half had [raised] legal implications which needed to be thoroughly followed before implementation,” said Makore in his opening remarks.

He also told the 15 managers who were in the meeting that the three months’ ultimatum to improve production was not realistic due to the financial position of the company, and also that the presence of the media at the meeting made it difficult to articulate all the problems affecting the colliery.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

“The minister seemed to have the wrong impression that the poor performance affecting HCCL was due to poor management and therefore more of a people issue than anything else, notwithstanding the working capital challenges,” Makore said.

“The minister also had the impression that management was not aggressive enough in dealing with the creditors who had resorted to litigation and dealing on a cash up-front basis.”

According to the minutes of the meeting, Makore felt that Chidhakwa was under a lot of pressure from his colleagues in government to ensure that production at the mine was increased following the acquisition of various mining equipment from Belarus and India.

Last year, HCCL commissioned new equipment under a $31,2 million vendor financing facility.

However, the equipment has been constantly breaking down.

HCCL has failed to ramp up output despite it projecting to reach 500 000 tonnes per month. The output was expected to be composed of Mota Engil’s 200 000 with the remainder from HCCL. Mota Engil was contracted to mine on HCCL concessions.

The meeting’s minutes showed that output has failed to reach the 500 000 tonnes target.

“Production target for the month was set at 300 000 tonnes, Mota-Engil targeting 200 000t and Opencast targeting 100 000 tonnes,” the minutes said.

The government is the major shareholder at the colliery. HCCL’s second largest shareholder Nicholas Van Hoogstraten has in the past accused management of running down the company.