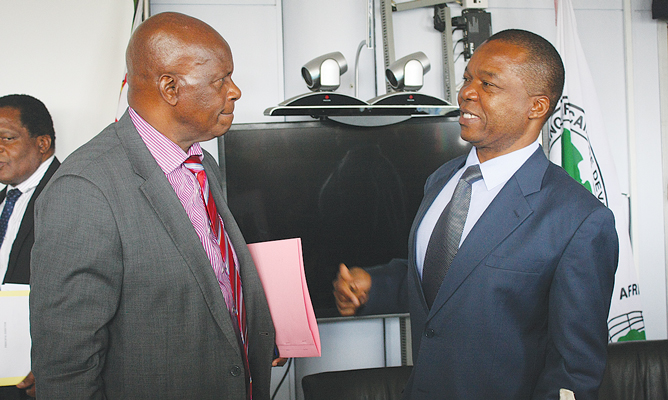

The printing of the bond notes under a $200 million export incentive facility will be monitored through an arrangement involving the buyer, supplier and financier, Reserve Bank of Zimbabwe (RBZ) governor John Mangudya has said.

BY VICTORIA MTOMBA

The African Export-Import Bank (Afreximbank) has provided a $200 million loan to back up the printing of bond notes that will be used to pay a 5% incentive to exporters.

“We have a tripartite arrangement of buyer, supplier and financier. The people who are printing the money know how much we are printing and against what are we printing.

“Exports come gradually. It’s a gradual process because exporters do not export every day,” Mangudya told Standardbusiness on Friday.

“We are not going to put money into the economy other than what has been requested by banks.

“When one exports, the bank which is handling the transaction will advise on the money that has been received and the exporters then get the 5%.”

Asked what happens to the other funds that will not be used to print the bond notes and whether RBZ would use the money to address the liquidity challenges, Mangudya said, “This is a standby overdraft facility so that we do not incur costs. We pay on what we withdraw.”

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

Mangudya said the bond notes would only be put in the economy as requested and not by any other means.

He said the sight of the bond notes would be a sign that money has been paid to exporters.

Afreximbank referred questions to RBZ when asked on the $200 million export incentive facility.

“Given that this issue touches on Zimbabwe’s monetary policy, for which the Reserve Bank of Zimbabwe is responsible, and since we are not part of the country’s monetary system, we would prefer that you refer the questions to the Reserve Bank, which is in a better position to provide the answers you need,” said Obi Emekekwue, the bank’s head of external communications.