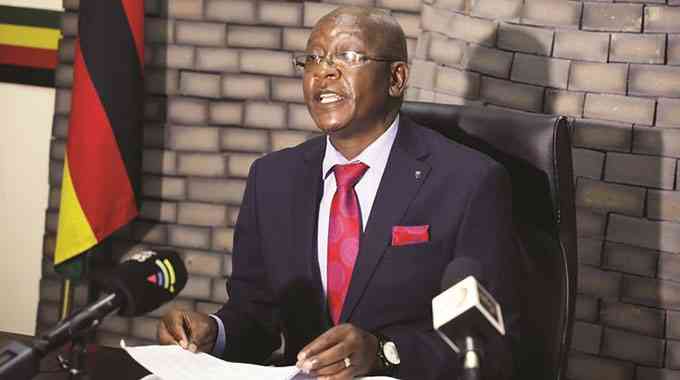

Reserve Bank of Zimbabwe (RBZ) deputy governor Innocent Matshe has encouraged small businesses to register with the Collateral Registry in order to borrow money for their operations.

About a month ago, the RBZ launched the Collateral Registry to increase the variety of assets that can be used to qualify lenders’ willingness to accept movable assets as collateral.

This is part of the central bank’s larger effort to expand access to credit and boost financial inclusion.

The registry is anticipated to have immediate and far-reaching consequences such as boosting micro, small, and medium-sized (MSME) businesses and finally increase output in the domestic sphere.

RBZ estimates that MSMEs contribute up to 80% of economic activity, up from earlier estimates of between 60% and 70%.

“Credit is crucial for some of the liquidity that our companies need.

“At the Reserve Bank, as Professor Makochekanwa (Albert Makochekanwa) points out, something like 60% to 80% of our economy is informal.

“We have realised at the central bank that there is need to provide access to credit for small businesses, so because of that a month ago we launched the collateral registry,” Matshe said, at the launch of the Zimbabwe National Chamber of Commerce second edition of its annual State of Industry and Commerce Survey 2022.

- RBZ blocks Harare US dollar charges

- Industry cries foul over new export surrender requirements

- One stitch in time saves nine

- Banks keep NPLs in safe territory

Keep Reading

“The collateral registry allows financial institutions to lend to small businesses using movable property.

“So you can use your car, you can use your sawing machine, you can use your cattle, to get loans for your business.”

Matshe said the registry made lending transparent, for both the lender and the borrower.

“I know there are issues we will have to deal with, but generally that is the idea and it makes impossible for the borrower to use the same asset or to over borrow on the same asset,” he said.

“On the other hand, the lender will have the collateral that they need.

“The second issue, we deal with concerning the collateral registry is to make sure that because you use your sawing machine for your business, you can’t hand it over.

“Sometimes, for a very small amount, they can take a large capital asset.

“You fail to pay this small amount; they sell out as collateral and disenfranchise the business.

“For small businesses, these may seem like small things, but they are actually big things if you consider the fact that upwards of 60% of businesses are informal.”

The Collateral Registry is a database that stores information on interests in ownership of personal property pledged as collateral for a loan.

The Registry allows secured creditors or lenders to record a security interest in personal property such livestock, household goods, crops, business stock, and accounts receivable, giving notice to the public of the existence of such a security interest.

The registry was established in terms of the Movable Property Security Interests Act [Chapter 14:35] which allows the use of movable assets as collateral for loans.

The RBZ said there should first be an agreement signed with the secured creditor before registering an interest in the Collateral Registry.

“There should be an agreement which is a signed, binding document between the lender and the collateral owner.

“An agreement is arrived at after the lender has carried out an assessment of the value of the movable property against which a potential borrower requires credit,” RBZ said, in a white paper on the registry.

“This is the contract between the debtor and the secured party in which the debtor agrees to grant a security interest in their asset to be used as collateral.

“A security agreement must be in writing and signed by the secured creditor and the debtor.”