PLATINUM Group Metals (PGM) miner Zimplats Holdings has spent US$702,1 million during the half year ended December 31, 2023 towards major capital projects, including the development of Mupani Mine and Bimha Mine upgrade.

In its half year report for the period ended December 31, 2023, the platinum miner said the Mupani and Bimha mine projects progressed as planned during the period, achieving nominal production capacity of 3,1 million tonnes per annum.

Mupani Mine targets a production capacity of 3,6 million tonnes per annum in August 2028.

“The mine upgrade is part of the replacement of production capacity from Mupfuti Mine which is scheduled for depletion in 2027. A total of US$77 million had been spent on this project as at December 31, 2023 against an approved project budget of US$82 million,” Zimplats chief executive officer Alex Mhembere said.

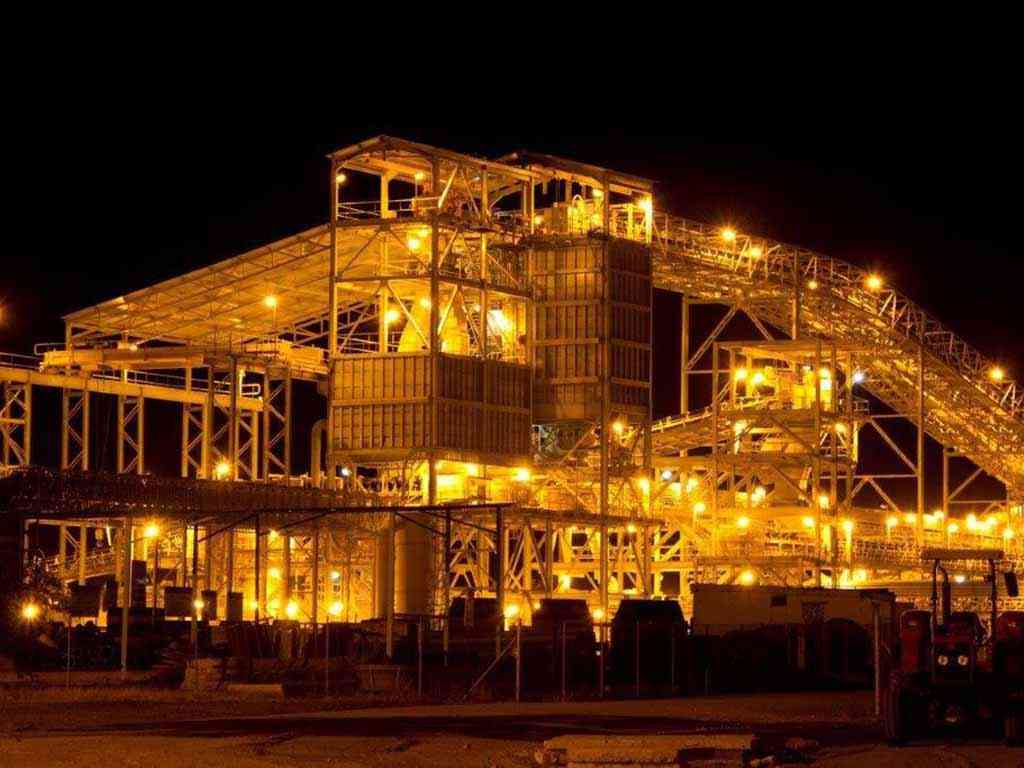

The smelter expansion project implementation continued with on-site construction and delivery of manufactured equipment in the half year under review. The project targets a capacity of 380 000 tonnes of concentrates (about 538 000 6E ounces).

The sulphur dioxide abatement project has progressed well with significant offsite equipment manufacture being complete, the company said.

In the period under review, a total of US$295,9 million (inclusive of US$75,9 million in prepayments) had been spent on both projects against an approved budget of US$521 million.

“The refurbishment of the mothballed base metals refinery at Selous Metallurgical Complex progressed well with a focus on early onsite construction activities, procurement of long lead equipment and metallurgical test work,” he said.

- Zimplats raises expenditure on environment rehab

- Zimplats sinks US$373,6 million into projects

- Zimplats revenue down 23%

- Zimplats invests US$516m on capital projects

Keep Reading

“The base refinery metal targets a capacity of 5 200 tonnes of nickel equivalent to current production volumes. As at December 31, 2023, US$18,5 million had been spent on the project, against a project budget of US$190 million.”

Mhembere said the Solar PV Plant Phase 1A was approved by the board in March 2022. The project is planned to deliver a power output capacity of 35MWac against a total output capacity of 185MWac planned across four project implementation phases.

The project has an authorised capital budget of US$37 million. Zimplats said onsite construction and equipment deliveries are in progress with a cumulative US$35 million (inclusive of US$19,7 million in prepayments) committed in the period under review.

The PGM miner suffered a 32% decline in revenue for the half year period compared to the prior period due to the softening metal prices.

Gross revenue per platinum, palladium, rhodium, gold, ruthenium and iridium (6E) ounce sold declined by 38% to US$1 164.

“The operating environment characterised by softening metal prices has affected the financial performance in the period under review,” he said.

“In response, the company has instituted a number of survival strategies with stringent measures to contain costs and preserve cash. We remain focused, committed, and determined to ensure the overall success of the business.

“In addition, the group’s focus on safety remains unwavering and we continue to invest in resources and technologies to ensure the achievement of our zero-harm goal.”

The group, however, experienced a 10% increase in sales volumes of 6E ounces to 320 196 ounces compared to 291 751 in the prior period.

The cost of sales at US$342 million was 8% higher than the same period last year’s US$315,6 million. Consequently, the gross profit margin was 8%, a 34 percentage points reduction from 42% achieved in the same period last year mainly due to the impact of higher than budget operating cost per 6E ounce in the current period.

The group’s operating costs increased by 1% owing to local inflation and an increase in labour headcount due to the introduction of the Third Concentrator plant and pillar reclamation.