TOTAL foreign currency receipts were up 3,77% last year to $5,5 billion, the Reserve Bank of Zimbabwe (RBZ) said on Friday while calling for efficient use of the foreign currency and adoption of plastic money for domestic transactions.

BY TATIRA ZWINOIRA

Addressing tourism players on the $15 million facility the bank has set aside for the tourism industry, RBZ governor John Mangudya said the money was earned from exports, diaspora remittances, international remittances and loan proceeds.

In 2016, Zimbabwe received $5,3 billion in foreign currency earnings. He said the figure was huge despite the shortage of foreign currency in the market.

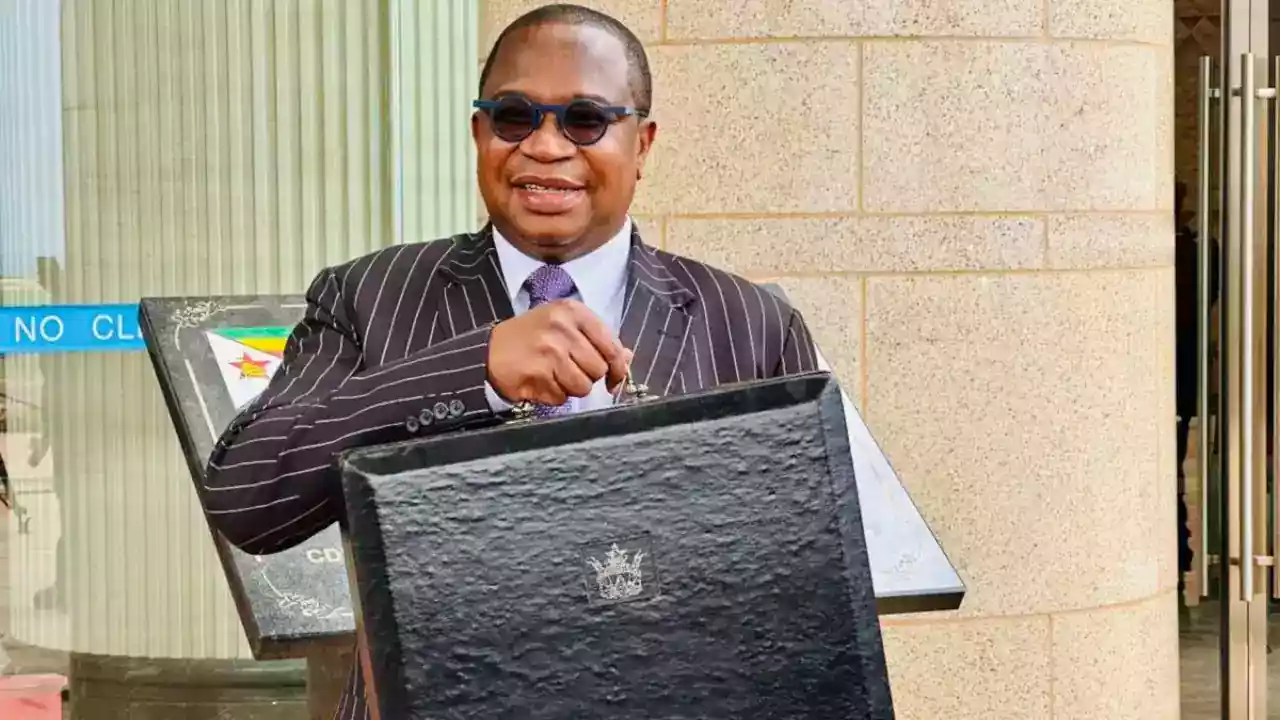

“But, people are always saying there is a shortage of foreign currency in Zimbabwe. This [$5,5 billion] is more than Honourable Chinamasa’s [Finance and Economic Planning minister Patrick Chinamasa] budget that we have earned as an economy in terms of foreign exchange. But with its utilisation, when you now use foreign currency as well as a domestic currency, it means that demand becomes higher,” Mangudya said.

He said if the foreign currency exchange was being used for the purpose of paying foreign payments, then it would be used in a productive and efficient manner.

“But, we also use it ourselves as a domestic currency and there is nothing wrong about it. So it means that we need to use more plastic money so that we do not put too much pressure on our foreign currency so that once we have earned, we can use that for foreign payments.”

The improved foreign currency generation comes mainly from a general improvement in export receipts as the central bank and government stepped up efforts to incentivise exporters.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

There was also an improvement in gold production — one of the country’s two main sources of foreign currency— whose production shot up by 18% to 24,8 tonnes by the end of 2017.

However, for the country’s other main source of foreign currency, tobacco; export receipts were down by 2,46% to $904 million from the previous year.

Mangudya said the bank would this year sweat out the real time gross settlement balances to further increase the foreign currency generation in the country, which would put less pressure on foreing currency and increase it in the process.