By Kuda Chideme

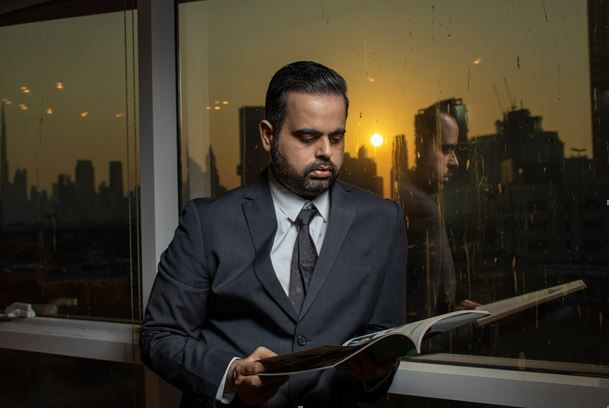

Old Mutual Zimbabwe group chief executive Jonas Mushosho, is set to leave the financial services giant before year end, at a time the firm is restructuring and bundling up its business operations.

Mushosho, who is a chartered accountant and an MBA graduate, has been with Old Mutual for 28 years, shepherding the group through some of the most turbulent times such as the hyperinflation era, which was characterised by policy uncertainty and government’s drive to nationalise foreign-owned companies under the guise of empowering locals.

He also doubled as the chief executive of the Old Mutual Emerging Markets’ rest of Africa business, which housed the group’s African operations save for South Africa.

According to sources close to the developments, an exercise to find a replacement for Mushosho is already underway.

“He will be missed. They loved him across the group. That’s why he was given so much responsibility,” a source said.

“He understood the turbulent environment and steered the group through it all. He’s going to be difficult to replace.” Group chairman Johannes Gawaxab said following the managed separation that saw Old Mutual’s headquarters return to Africa, the group had clustered its operations based on the major lines of business.

The group’s businesses activities include life assurance, short-term insurance, property investment, and asset management.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

The property portfolio has assets that span across retail, industrial, central business district offices, office parks and land.

It also owns the Central African Building Society (CABS), which is considered the third largest bank in Zimbabwe with an asset base of over US$1,2 billion.

“Having reviewed the current structure of the Old Mutual Zimbabwe Limited Group, the directors have concluded that the interests of both shareholders and customers would be best served by restructuring the group into a simpler and more optimal outfit,” Gawaxab.

“The process entails the proposed clustering of the Old Mutual Zimbabwe Limited businesses into three clusters on the basis of the major lines of business which the group operates, namely, insurance, wealth management and banking — subject to regulatory and shareholder approvals as necessary.

“Old Mutual Zimbabwe Limited will remain as the holding company of these three clusters.

“The exercise is also intended to streamline the ownership of Old Mutual Insurance Company.

“It is expected that this will result in a reduction of the legal entities in the Group”.

Giving a trading update, Gawaxab said the company had experienced a difficult trading environment in the first quarter in line with general patterns observed in the market.

“This business and its customers have been adjusting to the impact of the policy changes announced in the monetary policy statement of 21 February, the most significant of which was the introduction of an interbank market for the foreign currency and the introduction of a new currency, the RTGS dollar,” he added.

“We are also negatively impacted by the performance of the ZSE up to the end of March. It is worth noting, however, that the market has since recovered significantly in April up to date and we expect this trend to continue.

“Performance across our core operations has remained remarkably resilient and after normalising for the impact of transitioning to the new currency regime, profits have been in line with expectations.

“Expense growth was significantly below the year on year inflation numbers released for March”.

Going forward, Gawaxab said the business was well placed to withstand the economic headwinds being currently experienced.

In the full year to December 2018 the group recorded a 41% increase in revenue to US$1,4 billion from US$991 million in 2017 due to growth in investment gains and banking interest income.

Old Mutual Zimbabwe Limited is a 75% owned subsidiary of Old Mutual Zimbabwe Holdco Limited which is a wholly owned subsidiary of Old Mutual Limited registered in South Africa.