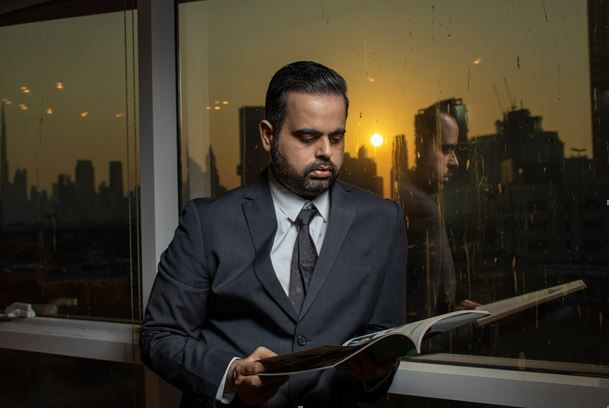

RESERVE Bank of Zimbabwe (RBZ) governor John Mushayavanhu on Friday declared that he will protect the central bank from external forces to maintain its independence.

But analysts were quick to describe his bold statement as rhetoric, citing Zimbabwe’s toxic political environment.

Presenting his maiden 2024 monetary policy statement (MPS), which ushered in the new currency called Zimbabwe Gold (ZiG), the newly appointed governor declared that he would discontinue all quasi-fiscal activities, and contain money supply.

“I don’t believe in quasi-fiscal activities,” Mushayavanhu said.

“It’s not going to happen under my watch.

“My mandate, as spelt out in the Reserve Bank Act, is very clear and I have no intention or whatsoever to do other people’s jobs,” he declared.

“I will do my job as the central bank governor as defined in the Reserve Bank Act.

“In that respect, we have moved all quasi-fiscal obligations that had been created, some not out of our make.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

“I think the (former) governor (John Mangudya) will tell you that we had a foreign exchange crisis and he had to do something to address that.

“In fact, he calls them quasi-foreign currency fiscal operations, but that is the past.

“We are not going to be in any quasi-fiscal activities. We have moved the balances to the Treasury in an effort to clean up the balance sheet of the central bank.”

He added: “In that respect also, people have said that, ‘well the problem is that the Treasury, from time to time, will come and borrow money from the central bank'.

“Again, under my watch, if there is going to be any accommodation at all of the Treasury, it is going to be within the limits contained in the Reserve Bank Act.”

The central bank engaged in quasi-fiscal activities over the years, among them was the farm mechanisation initiative, which the Treasury ought to have overseen.

Mushayavanhu also said the bank will continue to maintain a tight monetary policy stance to ensure sustainability of the monetary anchor to control excessive money printing.

“If printing money could make nations prosperous, then there would be no nation which is a third world nation,” he said.

“We have learnt from past experiences that it does not help to print money. Certainly, not under my watch, it’s not going to happen.”

But economists said it would take serious political will for him to achieve the central bank’s independence.

“The new governor has already started on the wrong footing. He should have spent his first three months reading the room through stakeholder consultation to foster confidence,” economist Chenayimoyo Mutambasere said.

“Instead, he started with a new statute, a new currency, and very low import and mineral reserves. It’s unprecedented for a new governor to hit the ground running with such clumsy speed.

“This is the same trick used by his predecessor. He will make his mark with the next phase of hyperinflation for sure.”

Economist Vince Musewe said quasi-fiscal activities arise out of political rather than economic motives.

“I am not sure whether the governor has a final say on that,” Musewe said.

Gift Mugano, a professor of economics, described Mushayavanhu’s declaration as baseless.

“It is not him that will influence these promises he made. I do not think his predecessors, Gono and Mangudya, deliberately printed money without knowing what it meant,” Mugano said.

“It is not him who decides on the printing of money, and external influences on the RBZ decisions, it is the power of the political actors.

“So, my submission is that for him to be truthful to his word, it is the assurance that the political will, which he was not given on his duress status and he is not going to be a genius that can do something like that.”

Former Finance minister Tendai Biti said the new governor was set to fail as he has introduced the new ZiG currency without adequate reserves to support it.

“What caused money printing was not what happened at the RBZ,” Biti said.

“It is because the Finance minister cannot live within his means.

“Zimbabwe’s economic crisis is not a monetary crisis on which a reserve bank governor can influence; it is actually a fiscal crisis, fiscal indiscipline, and lack of fiscal consolidation.”

Economist Prosper Chitambara encouraged the government to exercise fiscal discipline and prudence, controlling public spending to sustain the new currency.

“I think we need, just for drought mitigation interventions, we need more than US$2 billion,” he said.

“So really that tells us that there’s going to be an increase in public spending this year, occasioned by the drought,” he noted.

“The issue of fiscal discipline, fiscal prudence, controlling public spending, obviously that’s a key part of the sustainability of any currency.

“Discipline itself is also important and implementing institutional reforms.

“I think that will go along in terms of restoring confidence in the local currency and ultimately confidence in the local economy.”

The structured currency is anchored on a composite basket of foreign currency and precious metals (mainly gold) held as reserves for this purpose by the reserve bank.