Rufaro Hozheri

Follow Rufaro Hozheri on:

Will new decree move the needle?

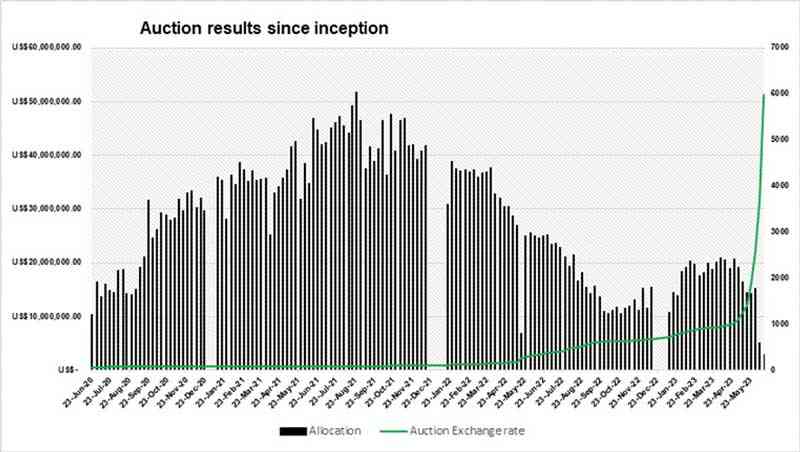

The foreign currency auction system introduced by the RBZ in June 2020 has been at the centre of most discussions for quite some time now.

By Rufaro Hozheri

Jun. 23, 2023

A market that loves corporate transactions!

Hawkish stance from monetary authorities usually sees the exchange coming off.

By Rufaro Hozheri

Jun. 30, 2023

Exploring Zim’s balance of trade

Gold has always been one of the highest foreign currency earners for Zimbabwe with two-thirds of the 35,1 tonnes produced and exported in 2022 coming from the small-scale miners.

By Rufaro Hozheri

Jul. 7, 2023

Late rains put pressure on tea production

Selling and distribution expenses also soared and contributed to the depressed operating margin.

By Rufaro Hozheri

Jul. 14, 2023

Mining, energy lead in FDI attraction

Among other sectors, the mining, construction and energy industries are attracting domestic and foreign capital, according to the report.

By Rufaro Hozheri

Jul. 21, 2023

Cash-rich Meikles retail expansion on track

The company’s ability to compete with the smaller informal players, especially in the dry groceries sector is also limited by the restrictions by authorities especially relating to exchange rate.

By Rufaro Hozheri

Jul. 28, 2023

US$ rights subscription on the ZSE, a loser’s game?

The other pivotal variable in the analysis will be the share price change of the counters.

By Rufaro Hozheri

Aug. 4, 2023

Bar set high for REITs to follow!

REITs in Zimbabwe are obliged to dish out to their unit holders a minimum of 80% of their distributable income,

By Rufaro Hozheri

Aug. 11, 2023

Is Zimdollar stabilising or losing relevance?

Due to the high cost of borrowing in local currency, economic agents have found themselves borrowing and lending in foreign currency.

By Rufaro Hozheri

Aug. 18, 2023

Is it the end of road for GetBucks’ ZSE listing?

It now seems very clear that the company will voluntarily delist from the bourse.

By Rufaro Hozheri

Aug. 25, 2023

Informalisation threatens formal business viability

It is now common practice in Zimbabwe that some locally manufactured products can now only be found at the tuckshops and not in the formal retail outlets.

By Rufaro Hozheri

Sep. 1, 2023

Why properties in Zim are overpriced

This explains why South Africa is our biggest trading partner and we import billions worth of finished goods from them.

By Rufaro Hozheri

Sep. 8, 2023

New wave of mergers in the banking sector

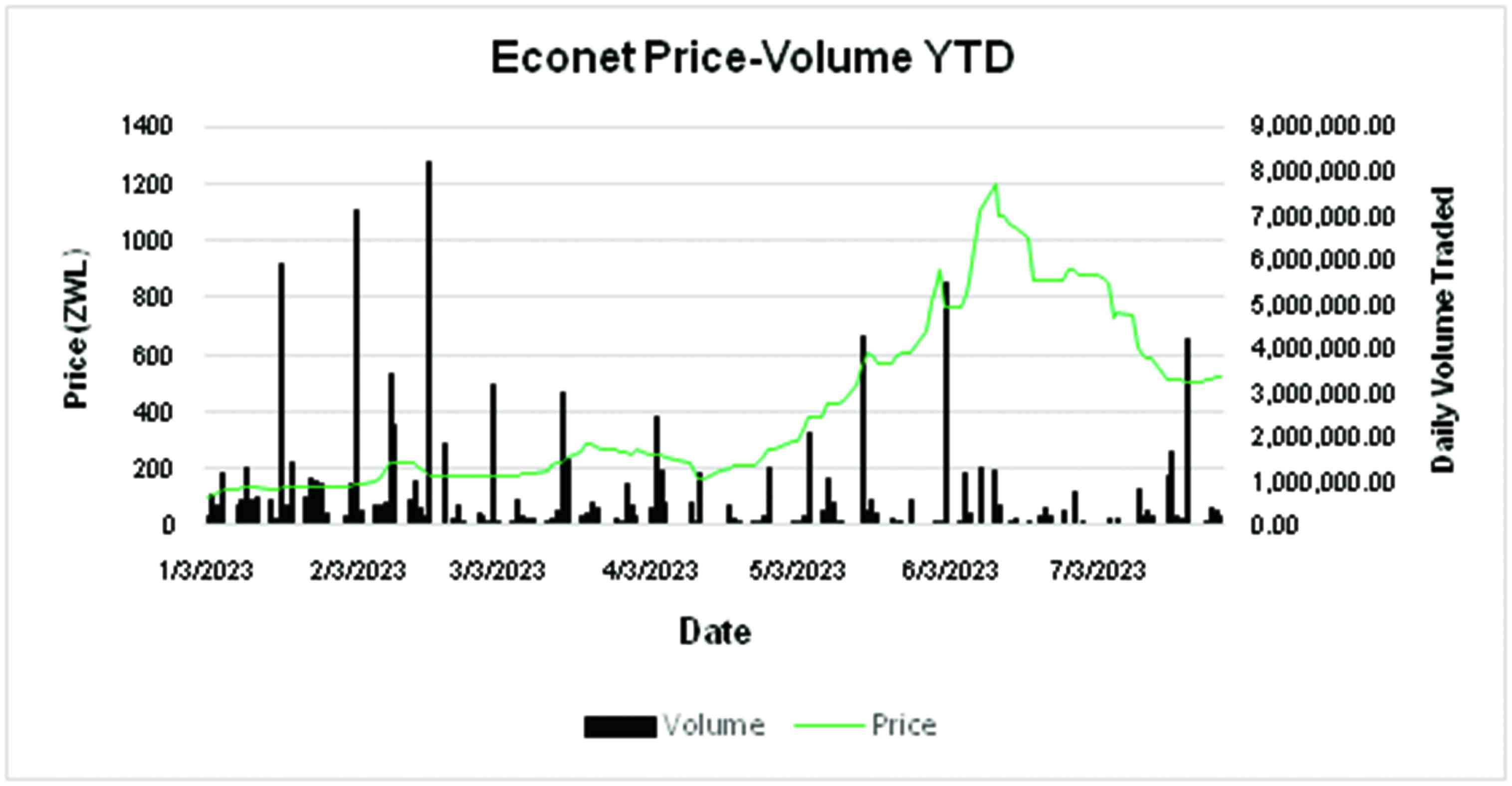

Econet Wireless and Cassava Smartech, now Ecocash Holdings, is another classical example of the divide and create value rule.

By Rufaro Hozheri

Sep. 15, 2023

BNC turns to high-volume, low-grade mining strategy

The decrease in turnover to US$49,5 million was a direct result of reduced nickel concentrate sales volume, despite the increase in nickel prices.

By Rufaro Hozheri

Sep. 22, 2023

Take-aways from Metro Peech & Browne case

Debt is like a double-edged sword, appropriately utilised can propel to company to grow but also has the potential of sinking down the company.

By Rufaro Hozheri

Sep. 29, 2023

Unpacking the Mutapa Investment Fund

Mutapa Investment Fund is a pool of resources i.e. public equities, commodity royalties and allocations from the government that will be invested in the future.

By Rufaro Hozheri

Oct. 6, 2023

So, is it a currency?

The crisis got the RBZ to introduce its latest instrument, Zimbabwe Gold (ZiG).

By Rufaro Hozheri

Oct. 13, 2023

SI 162: Too little, too late?

One of the recommendations of the Commission has led to Statutory Instrument 162, which instructed pension funds to compensate for loss of value.

By Rufaro Hozheri and Admire Dube

Oct. 20, 2023

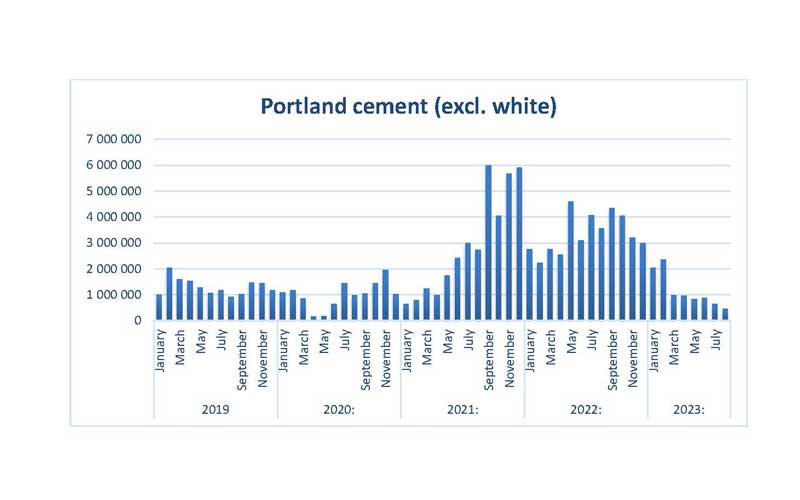

Cement crisis hits local market

The target in the National Development Strategy 1 is to build 225 000 houses by the end of 2025.

By Rufaro Hozheri

Oct. 27, 2023

Love–hate relationship with the US$ continues

Since then the USD economy has even increased to more than 80% and the majority of deposits in the banking system are now in US$.

By Rufaro Hozheri

Nov. 3, 2023

State of the economy: A helicopter view!

For some time now, Zimbabwe has witnessed excellent records of foreign currency inflows with the latest annual number being a record-breaking US$11,7 billion in 2022.

By Rufaro Hozheri

Nov. 10, 2023

Delta ponders US$ financial reporting

According to official numbers, the majority of transactions in the country are now concluded in foreign currency.

By Rufaro Hozheri

Nov. 17, 2023

New Revitus REIT bets on Harare CBD resuscitation

Any avid follower of our local capital markets can almost be certain that more are to follow.

By Rufaro Hozheri

Nov. 24, 2023

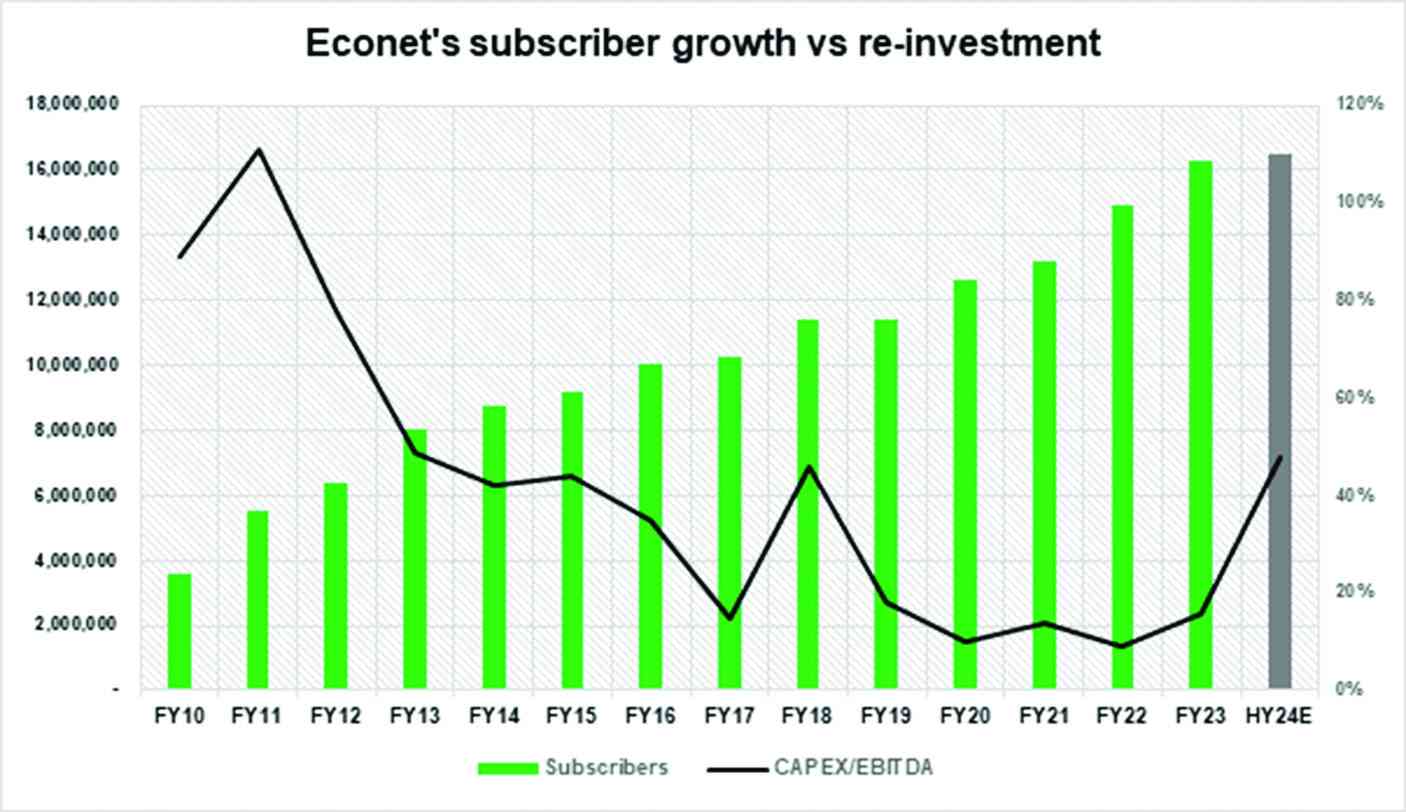

Econet Wireless’ silver jubilee

Lately, there has been a growing concern in the market over alternative internet service provision by the American company Starlink.

By Rufaro Hozheri

Dec. 1, 2023

Thoughts on the proposed 2024 National Budget

I think this is a noble idea in principle but not sure it will work well in its current proposed form.

By Rufaro Hozheri

Dec. 8, 2023

Expected drought weighs down Seed Co volumes

Seed Co Limited which has a rich history dating back to 1940 has grown to become a Pan-African household brand.

By Rufaro Hozheri

Dec. 15, 2023

Dissecting OK Zim’s business recovery plan, GROWTH strategy

The short-term priorities are anchored on volume recovery, cost rationalisation, and diversifying income streams.

By Rufaro Hozheri

Dec. 21, 2023

Taking stock of 2023

The bulk of import bill was spent on petroleum oils and light motor vehicles, which combined amounted to US$1,65 billion.

By Rufaro Hozheri

Jan. 5, 2024

Premium

Economic Viewpoint: Navigating Zimbabwe’s stock markets in 2024

The electricity situation leaves a lot to be desired with erratic power cuts, despite the expansion of units in Hwange.

By Sylvester Mupanduki and Rufaro Hozheri

Jan. 10, 2024

Counters to closely monitor in 2024

Although a commitment to maintain inflation under 20%, currency devaluation will also threaten real growth in 2024.

By Rufaro Hozheri and Sylvester Mupanduki

Jan. 12, 2024

Premium

Temba Mliswa: Zimbabwe’s most accomplished political opportunist or man of principle?

News

Nov. 2, 2025