THERE is no doubt that the introduction of new players in the “Delta space” has awakened the beverages giant from its comfort zone.

Whether you are talking about the sparkling beverages where the Varun Beverages’ Pepsi products are aggressively selling or the opaque beer division where the Nyathi beer is leveraging Innscor’s cash and distribution networks.

The good thing about competition, however, is that it pushes the parties to be more innovative, strategic, and decisive, and in this case, Delta had to put its house in order to remain competitive.

It had to sort out issues relating to pricing, distribution, supply, and even marketing campaigns. However, capital expenditure injections into new plants have been critical in pushing the beverages manufacturer forward.

According to the FY24 results, Delta reported that it had cumulatively invested amounts to the tune of US$100 million in improving its capacity over the past 24 months with US$48 million injected in the past year.

This money went towards a PET packaging line at Graniteside, Chibuku Super plant at Harare Brewery, a larger beer glass packaging line at Southerton Brewery as well as a Brewery in South Africa.

Delta also acquired Mutare Bottling Company from Econet Wireless to strengthen its sparkling beverages distribution in the eastern parts of the country. These investments translated into buoyant performance, with record sales volumes being recorded across the spectrum.

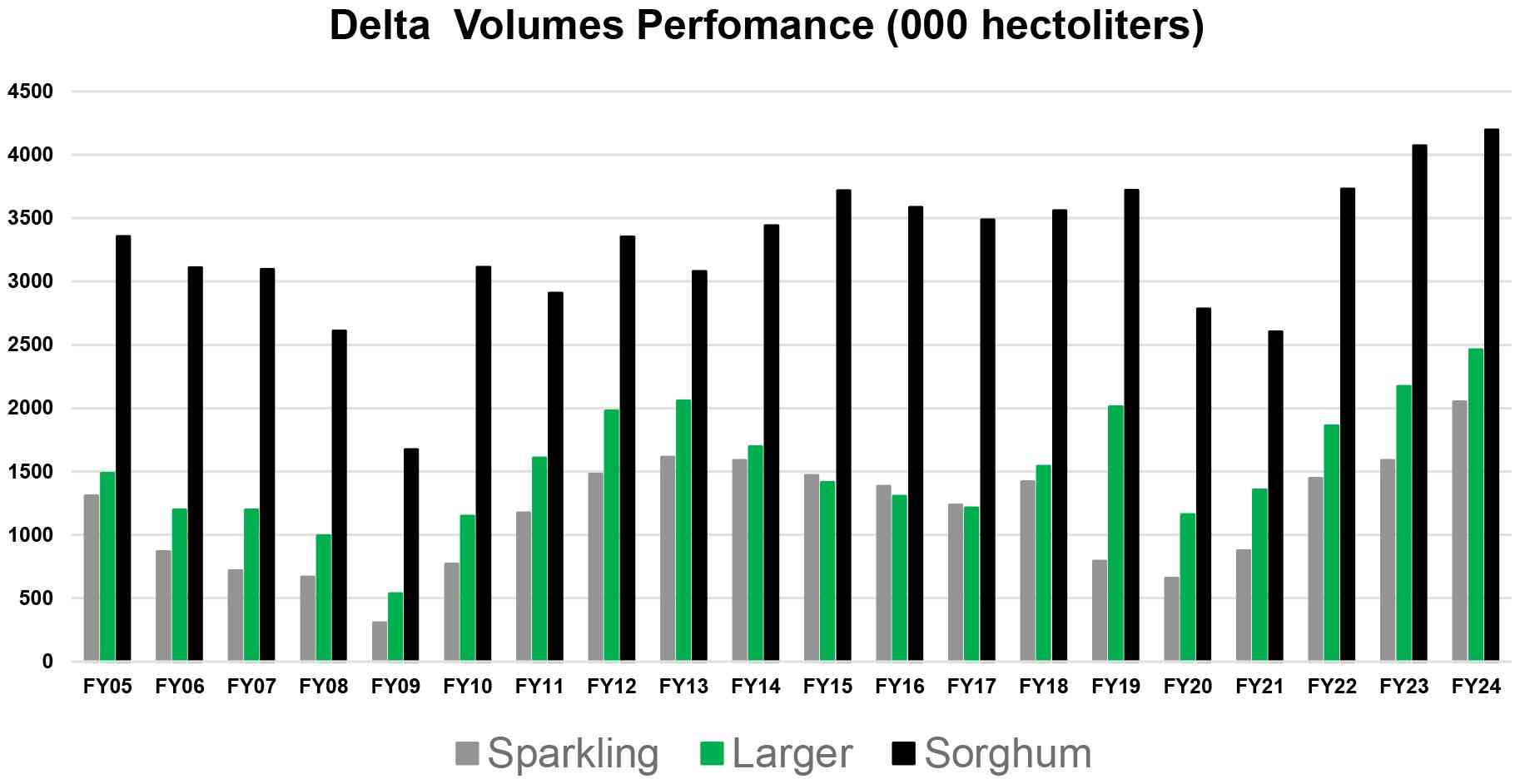

In the sparkling beverages division, Delta sold 2,053 million hectolitres, which translates to 205 million litres, resulting in just under 14 litres of carbonated soft drinks per head in the financial year. Even during the period between 2009-2013 when the country experienced phenomenal growth and Delta was more or less a monopoly in the space, it never witnessed such volume records.

- Mboweni mentors emerging entrepreneurs, calls for integrity in business

- Mvuma land dispute turns nasty

- Billionaire Strive Masiyiwa gains US$1,7 billion

- Mboweni mentors emerging entrepreneurs, calls for integrity in business

Keep Reading

The sparking beverages division only contributed 19,11% towards the group’s top line whilst the operating income contribution was 12,25%.

According to third-party research that was presented by Delta to analysts, in the sparkling beverages division Delta controls a 67% market share, up from 61% at the same time last year.

Whether one believes these numbers by the third party or not is debate for another day but perhaps one should appreciate how returnable glass bottled drinks form a significant portion of the volumes and significant capital expenditure has gone towards that.

The distribution channel, also referred to as the route to market is key in this red ocean. In the 2023 annual report, Delta reported that the bulk of its sparkling beverages were sold through wholesale, general dealers, and supermarkets.

Although without supporting evidence from Varun itself, it appears its strategy is to sell directly to the consumer through the vendors.

However, Delta hinted that in the fourth quarter, it also had disruptions in its route to market policies.

The sugar tax came into effect on 1 January 2024 as prescribed in the 2024 budget and subsequently, the finance act, and already the market is feeling the pinch.

The sugar tax has resulted in a tax-induced 32% price increase for the 300mls Coke and 36% for the 2 litre Mazoe, which is manufactured by Delta’s associate, Schweppes. Delta’s financial year ends on March 31 and the company already has a US$46,3 million sugar tax obligation. Going forward it will aggressively push for less sugar products to remain competitive.

Record volumes were also in the larger division where just under 2,5 million hectolitres were sold. The larger division is relatively more premium compared to the sorghum or opaque beer division as depicted by its 29% operating margin versus the 7% for the sorghum beer division. The sable lager, which was launched in 2022 also contributed to this performance together with the other capital expenditure exercises.

The Carling Black Label on its own recorded one million hectolitres volume.

Formal competition in this space is very minimal with the third-party research reporting that Delta controls 96% of the market share and has been fairly stable there.

However, the market is now infested with either cheaper imports or counterfeit products. Bars and bottle stores are a critical distribution channel for the clear beer with over 60% of the product selling through that channel.

Delta continues to leverage the strategic partnership that it created with these outlets in pushing its volumes.

Although still shy of the 1998 sales volumes, the sorghum beer division continues to soar with a sales volume of just under 4,2 million hectolitres.

The growth in the opaque beer division also signals the quality of life in the general economy as there is a tendency to switch to premium beer in good times and vice versa.

However, this indication should be used in conjunction with other metrics since also the larger division witnessed significant volume growth.

The Nyathi beer, which is a product of Innscor was launched in December 2022 under The Buffalo Brewing Company. According to Innscor, in 2023 they were reaching out to 40% of the beer and bottle stores as their strategy to enter the market.

Delta sells 51% of this product via bars and beer halls, with wholesale and distribution taking care of 36%. Although one can never write off Innscor's competition in any category in Zimbabwe, Delta seems to have a grip over this market with an estimated 91% market share from the same third-party researcher.

Delta also owns more than 50% stake in African Distillers, which is a wines and spirits manufacturer. An overall marginal 1% volume growth was recorded at Afdis despite the spirits division taking a 2% drop to 7,1 million hectolitres.

The wines barely moved whilst the ciders were up 5%. Delta now also has operations outside the Zimbabwean borders, in Zambia and South Africa. Although admitting that it has not been an easy start in these markets, the company remains positive with capital expenditure being deployed in Pretoria.

Delta has reported impressive volume growth but it by no means represents that its problems are behind it. Fierce competition is still starring in its eyes and should continue to stay on its feet to survive in this market. However, this competition has proved that the pie is way bigger than anyone ever thought.

- Hozheri is an investment analyst with an interest in sharing opinions on capital markets performance, the economy and international trade, among other areas. He holds a B. Com in Finance and is progressing well with the CFA programme. — 0784 707 653 and Rufaro Hozheri is his username for all social media platforms.