The US stock market experienced one of its most remarkable single-day performances in modern history on April 9, 2025, as the S&P 500 (SPX) soared by 9.52% to close at 5,456.90 points.

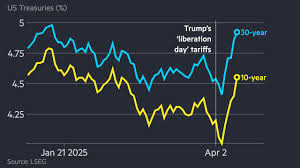

This extraordinary rally, which marked the index's largest single-day gain since 2008, came in direct response to President Donald Trump's announcement of a 90-day pause on recently implemented reciprocal tariffs for most non-retaliating trading partners.

Last Wednesday's rally was triggered when Trump declared on his Truth Social platform: "I have authorised a 90-day PAUSE, and a significantly reduced Reciprocal Tariff during this period, set at 10%, effective immediately". This policy shift represented a dramatic reversal from the sweeping tariffs that had been implemented just hours earlier, which had sent markets into a tailspin over the past week.

While most countries received a reprieve, China notably did not benefit from this pause.

Instead, Trump increased tariffs on Chinese goods from 104% to 125%, citing "the disrespect China has shown to global markets" as per his Truth Social Platform. This came after China had raised its own levies on US goods to 84%.

The market's response was nothing short of euphoric. Nearly every company in the S&P 500 saw gains with technology stocks leading the charge.

As visible in the attached table, tech giants posted remarkable single-day gains: NVIDIA jumped 18.72%, Tesla soared 22.69%, Apple climbed 15.33%, and Meta rose 14.76%.

Other notable performers included Amazon with an 11.98% gain and Microsoft adding 10.13%.

- The brains behind Matavire’s immortalisation

- Red Cross work remembered

- All set for inaugural job fair

- Community trailblazers: Dr Guramatunhu: A hard-driving achiever yearning for better Zim

Keep Reading

Perhaps equally telling was the dramatic drop in the CBOE Volatility Index (VIX), often referred to as Wall Street's "fear gauge," which plunged by 35.75% after having spiked to pandemic-level highs earlier in the week.

This substantial decline in volatility indicates a significant easing of investor anxiety.

As per CNBC report, Trading volume reached historic levels, with approximately 30 billion shares changing hands — marking the most active trading day in Wall Street history based on 18 years of data.

The extraordinary volume underscores just how significant this market event truly was.

If there's one lesson this week has hammered home for me, it's that "time in the market beats trying to time the market."

The speed and magnitude of Wednesday's rally demonstrate how quickly sentiment can shift and how costly it can be to sit on the sidelines.

If you had missed just this one trading day while waiting for "the right time" to invest, catching up to benchmark returns would become extremely challenging.

I have shared this philosophy repeatedly on my YouTube channel (Streetwise Economics), emphasising quality businesses rather than trying to predict short-term market movements.

Wednesday's performance vindicates this approach—I saw very significant gains in my equity positions, which reinforced my conviction that focusing on strong fundamentals rather than market timing is the more reliable strategy.

While the market has recouped much of its recent losses, I believe we're not entirely out of the woods yet.

The coming three months could see further upward momentum as relief continues to spread through the market, potentially followed by a period of stagnation as investors fully process the new tariff landscape.

We should expect continued volatility — a hallmark of the current administration's policy approach. As one analyst told Bloomberg, the tariff pause "injects some much-needed stability into a market rattled by uncertainty.

That said, we're not out of the woods yet".

On the risk side, I'm particularly concerned about economic data that might eventually reveal the true impact of even the reduced reciprocal tariffs.

Such effects typically take time to materialise in economic indicators, which is why I'm maintaining a prudent approach to risk management.

This week's market action has reinforced several key elements of my investment approach:

- Maintaining a cash reserve: I'm keeping some powder dry, having not fully deployed all available capital into equities. This gives me flexibility to act on future opportunities.

- Strategic hedging: I'll continue to use the VIX as a hedging instrument and employ options strategies to protect my portfolio from potential downside. I will wait for it to drop to my buy levels though.

- Cash-secured puts: This strategy has been particularly effective this week. Some puts I sold just yesterday and today have already become profitable, allowing me to reduce risk in my portfolio while generating income. I cashed them all out on my trades and took profit off the table when stocks rallied today.

- Covered calls: On a case-by-case basis, I'm writing covered calls on existing positions to generate additional income, a strategy I've detailed in videos on my channel.

- Selective opportunities: I see potential in some undervalued companies that may still be depressed due to tariff concerns, particularly in certain Canadian and US sectors.

However, I'm approaching these opportunities with caution.

- Disciplined options approach: I avoid naked options positions, preferring strategies with predetermined risk/reward ratios. This disciplined approach has served me well during market turbulence.

If there's another lesson this week has reinforced, it's the importance of humility in the markets. Just when you think you have it all figured out, the landscape shifts dramatically.

The $4 trillion in market value created today is a powerful reminder that markets can move in unexpected ways and with breathtaking speed.

Nobody can predict the market with 100% certainty—there are simply too many moving parts and potential shocks that could send stocks tumbling again.

That's why I remain vigilant, staying abreast of economic data and policy developments that could impact market conditions.

As investors, we must balance conviction with flexibility, confidence with caution. Today's rally was certainly a welcome development, but it doesn't change the fundamental approach of focusing on quality businesses, managing risk prudently, and maintaining a long-term perspective.

For more detailed strategies, specific trade ideas, and ongoing economic analysis, visit my website at www.streetwiseeconomics.com to book a 1:1 consultation.

As always, remember that investing is deeply personal—what works for my risk appetite and financial goals may not be appropriate for everyone.

*Isaac Jonas is a Canada-based economist and principal consultant at Streetwise Economics. He is also a retail investor, retail trader and content creator, focusing mainly on the US and Canadian capital markets. He regularly shares insights via his social media handles and YouTube channel (Streetwise Economics). His website is www.streetwiseeconomics.com and can be reachable on isacjonasi@gmail.com. Insights shared in this article are based on current market conditions, which may be subject to change, hence this article does not amount to investment advice.