FACTORING provides a solution to addressing the financing gap for small to medium enterprises (SMEs) to support Africa's structural transformation, particularly in trade development as part of the African Continental Free Trade Agreement.

However, the development and use of factoring as an alternative trade financing tool to support Africa’s SMEs is at its infancy stage compared to other regions.

The key drivers for factoring are the demand for funding SMEs as an engine for economic growth, innovation, and scope for expansion of factoring products.

However there are significant barriers to overcome, such as lack of familiarity with the concept, challenging domestic environment, including competition from banks, limited number of factoring companies, inadequate legal and regulatory framework, problems with taxation and high transaction costs, limited credit insurance, and policy environment characterised by policy inconsistencies.

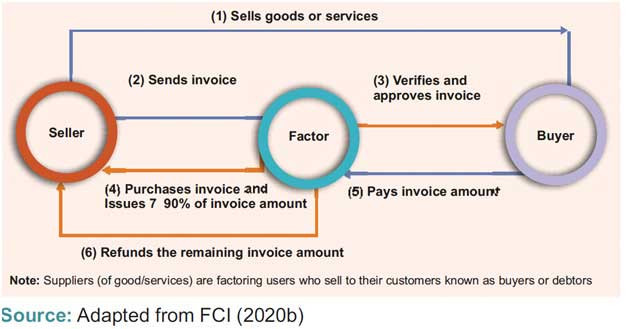

The factoring processes

Different types of factoring exist - factoring with recourse, non-recourse factoring, and invoice discounting relating to the way a transaction is made.

Factoring with recourse is where the client that is seller is not protected against the risk of bad debt in the case of uncollectable debt, the client (seller) bears the loss.

In factoring without recourse (known as non-recourse factoring), the factor bears the loss of a non-collectible payment.

- Handling scenarios not covered by IFRS

- SMEs urged to adopt business models to promote economic growth

- Building capacity for factoring in Africa to support AfCFTA

- HCC guns for space barons

Keep Reading

Non-recourse factoring effectively means that if there is an issue with payment, an insurance claim is made against the buyer, and the client (seller) need not pay.

Invoice discounting differs from the other types of factoring, as the buyer is not notified of the reassignment of an invoice to the factor.

Key benefits of factoring

Factoring as alternative financing for SMEs to implement the AfCFTA. SMEs face greater financing obstacles than larger firms due to higher transaction costs and risk premiums with banks often unwilling or unable to consider the sector as an attractive and profitable market.

The factoring product is recognised by governments and central banks as a safe and secure means to finance trade and has become a growing source of external finance worldwide for SMEs.

Factoring offers an alternative source of financing for African businesses to increase trade under the AfCFTA.

Opportunities for market share

Without factoring, a business will be out of stock and other companies will take their market share.

It can take on new orders, which would not have happened without the quick cash raised against unpaid invoices to have access to working capital and respond quicker to customers' needs and market opportunities for growth by boosting sales rapidly.

Flexible and scalable

Factor agreements can be adapted to fit the changing/evolving needs of an organisation.

For example, a business can decide to factor in all invoices or choose to factor in no invoices.

Quick cash required for a new opportunity or other business needs can be secured easily.

Credit screening

The funding is based on the creditworthiness of a company's customers rather than the borrower's own financials.

The factor conducts the assessment for creditworthiness and once customers are approved, the factor purchases invoices, advances cash to the company, and collects the debt from the customers later.

Saving time, facilitating procedures

Without factoring businesses wait for a considerable period (for example up to 90 days to receive payments) or longer if the time from ordering, customs clearance is considered.

Morocco has a law to limit payment periods to 60 days, but it is difficult to enforce, and penalties are not defined for late payers.

Factoring simplifies the collection of invoices by transferring them to the factoring company working with clients in a way that is not detrimental to customer relationships.

Building loyalty from suppliers

Raising cash against unpaid invoices ensures that suppliers are paid earlier to build loyalty or trust and to secure generous discounts.

It addresses the needs of customers requesting long-term payments and those who pay late.

Keeps balance sheet clean

Unlike bank loans, factoring does not show up on a company's balance sheet as debt, which will improve leverage with room to grow. Factoring provides control of a company’s finances by retaining equity rather than seeking investors for portions of equity.

No collateral is required

Provides financing without securities, which is good for SMEs with smaller balance sheets. Many SMEs do not have access to bank borrowings, as banks are generally reluctant to provide funding to companies with smaller balance sheets.

Debtor protection

Help companies to create a more predictable cash flow; and allow for the conduct of business with approved credit for customers.

Key capacity issues

The African Capacity Building Foundation Framework (ACBF, 2016) clustered capacity issues into two dimensions — institutional (relating to operational and composite capacities) and human capital (relating to critical technical skills and transformative capacity). Training and skills development are required to build the capacity of factoring companies in exploiting innovations and strengthening entrepreneurship to boost the export capacity of SMEs to increase intra-African trade. Equally important is the need to build capacity in credit risks and insurance for the development of credit information systems and to expand insurance schemes. The capacity needs of other stakeholders - regulatory bodies, legislators, buyers, private sector to support factoring should also be addressed to increase the number of supply chain specialists, trade economists, trade law specialists, financial experts, and logistics/freight experts.

Building skills in digital technology as a key driver for the growth of factoring companies, SMEs, and fintech companies will speed up innovation and digital solutions to boost trade finance.

In conclusion, factoring provides a solution to address the financing gap, particularly for SMEs as it would help innovative enterprises to grow through trade development and advance the implementation of AfCFTA for Africa’sstructural transformation.

Zvendiya is an independent policy analyst. — rzvendiya@gmail.com. His interests are in socio-economic policies, public finance management, informal sector, domestic resource mobilisation, mineral resource governance, illicit financial flows and taxation. These weekly New Perspectives articles, published in the Zimbabwe Independent, are coordinated by Lovemore Kadenge, an independent consultant, managing consultant of Zawale Consultants (Pvt) Ltd, past president of the Zimbabwe Economics Society and past president of the Chartered Governance & Accountancy Institute in Zimbabwe (CGI Zimbabwe). — kadenge.zes@gmail.com or mobile: +263 772 382 852