Leading funeral insurer Nyaradzo Group was a victim of a fierce social media campaign where it was accused of profiteering at the expense of clients.

The activist behind the campaign Alistar Nyamarari Chibanda has since retracted his claims and apologised to Nyaradzo, claiming that he was misled by persons who gave him tipoffs about Nyaradzo’s alleged misdemeanours.

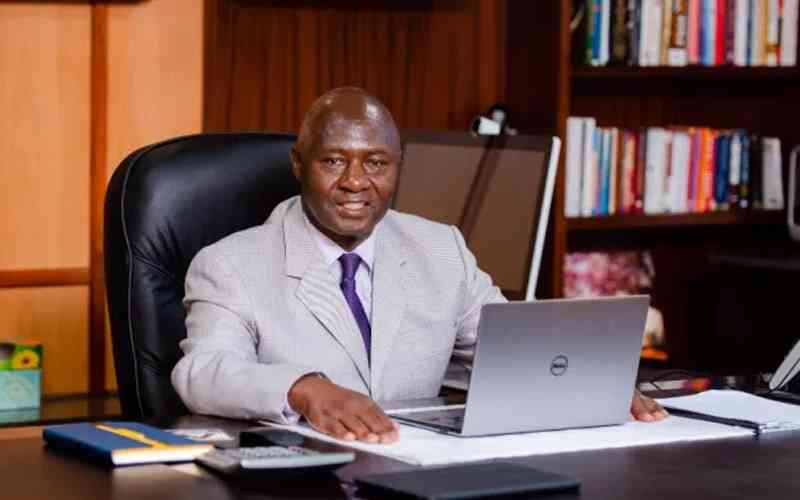

Nyaradzo Group CEO Philip Mataranyika (PM) spoke to economic analyst Vince Musewe (VM) about the episode and the state of the insurance industry in a wide-ranging interview.

Below are excerpts from the interview.

VM: Philip, the Nyaradzo brand went through some bashing on social media recently, what has been the impact?

PM: When the recent debates on social media and elsewhere started, we took time to listen to what was being said, noting what we felt were genuine concerns while sifting through what we felt were sentiments entirely aimed at hurting the brand.

Nyaradzo has always been the one friend you can count on during life's most trying times.

As a brand, we are committed to our clients with whom we have walked through difficult times.

- Matiza’s widow in estate wrangle

- SA insurer targets Zim after US$2.4 million payouts

- Addressing climate change the green building way

- Hit hard by storms and forest loss, Zimbabweans building stronger homes

Keep Reading

As such, we were humbled to see many people from different walks of life, our clients included, defend the brand and show how much they know about our products and services.

We also identified some information gaps, which we are now working on plugging.

There were many learning points regarding the needs of the Nyaradzo client of today.

We also took advantage of the increased publicity to reach out to existing and potential clients to whom we reaffirmed our commitment to being at their service at all times.

VM: Do you have any reason to believe your detractors were disingenuous and had ulterior motives?

PM: I cannot comment on their motives as I have no idea what it is they sought to achieve, only they would know.

I would like to say that Nyaradzo’s doors are always open to all forms of feedback, especially from existing and potential clients.

However, this particular incident seems to have been orchestrated by those with little knowledge about the workings of insurance.

Instead of bashing them in return, we will go out to educate them, so they are better informed.

You know as well as I do Vincent, that insurance is a very complicated subject.

Consequently, product development and pricing is done by specialised people called Actuaries who spend years in school, doing complicated mathematical calculations to work in the industry, practising what they learn at school.

VM: Why did you feel the need to respond directly to your clients as the CEO?

PM: You must understand that Nyaradzo has always been a customer-centric organisation.

We deeply care for our clients to the point that we leave no stone unturned in our efforts to amaze them, even when it means getting the CEO's hands dirty while serving clients.

We don't think having the CEO hide in a bunker somewhere instead of attending to client enquiries is a good idea.

One of our cardinal philosophies is that we listen, understand and provide solutions.

You can't do that hiding in a bunker, you have to engage with customers, which is what I do all the time.

VM: We have seen letters of apology on social media from those who made the false allegations.

Are you going to take any further action, including legal?

PM: Those who came forward to retract and apologise may have themselves been victims of false information.

We knew even as this started and spread that once they had access to correct information and if they are decent beings, the natural response would be to apologise and retract, which is what they did.

We are not pursuing any legal action against them; on the contrary, we have warmly welcomed a significant number of them into the Sahwira family.

Nyaradzo’s doors remain open to everyone who wants an all-weather friend, regardless of background.

VM: I am aware that Nyaradzo does a lot of public service free of charge e.g during Cyclone Idai and the Gwanda and Nyamakate bus disasters among others.

Why don't you use this for marketing purposes and also to silence your critics?

PM: We do not invest in corporate social responsibility - including assisting the public in times of disaster so we can parade it as a badge of honour.

We do it simply because we come from people and are of the people. We also believe in something other than blowing our own trumpet as a strategy for marketing; we let our service provision speak for itself.

We believe that a happy customer is the best marketer of our brand.

VM: One of the issues raised during the time of the debate is that of maturity of funeral policies, what have you to say?

PM: Let me clear running misconceptions regarding insurance products pricing, structure and design.

Maturity is not the holy grail of insurance products, there are other factors that draw clients to particular policy types, such as inclusivity, affordability, flexibility and simplicity, which are equally important, depending on what the client is looking for.

To give perspective, in the past, there wasn't much choice on the menu as the policies available at the time covered only principal members, their spouse and biological children and had a term to maturity.

Members of the extended family such as parents and in-laws were not eligible for cover; worse, those with pre-existing conditions and those above the age of seventy were not covered.

The only option for the extended family back then was prepayment plans or payment in cash at the time of death and service provision.

We reconfigured that with the introduction of our new generation policies such as the Six Pack and Score Pack Plans, making it possible for principal members to include any member of their family as beneficiaries, including those previously excluded.

With this innovation, one can now cover the whole village regardless of age, health and other considerations as long as they can afford the premium.

The only condition that those to be covered must fulfil, is a waiting period of three or six months before cover can commence.

Maturity is not available on this generation of policies, given the diverse risk profiles of those covered.

Remember Vincent, you can't have your cake and eat it too.

In other words, once you choose factors such as inclusivity, affordability and flexibility, you can't have maturity on the same policy.

Although possible, such a product's pricing would be prohibitive to defeat the initial objectives of inclusivity, flexibility, simplicity and affordability.

VM: The other issue raised was that of cash back on funeral policies.

PM: Vincent, you know when parties contract, there always are terms and conditions.

Cash back is not provided for on existing policies.

Now that clients have given us feedback to the effect that it is something they would consider as part of the menu, we will have to go to the drawing board and consult with our actuaries so they can price it.

As you know, benefits on insurance products go through rigorous tests, so insurance companies don't act like pyramid schemes that benefit early birds to the detriment of those who stay long on their books.

VM: Nyaradzo continues to dominate the funeral assurance and services market. Has this not created an unfair monopoly?

PM: We would like to thank our customers for entrusting us with their business; we are where we are because of their support.

Nyaradzo's growth is from prioritising customer satisfaction and not through anti-competitive practices.

Our business strategy is customer-centric, as we constantly look for ways to meet and exceed customer expectations.

We don't use devious means to acquire business, nor undermine other industry players, so there is nothing unfair about our rise to the top.

VM: The government is on a mission to increase financial inclusion.

How does Nyaradzo contribute to achieving this national goal?

PM: Financial inclusion is and has always been at the core of our business model.

Nyaradzo products are immensely popular with the market because they are inclusive and leave no one behind.

We have pretty much a product for each and every one of our potential clients, from your widowed grandmother in the rural areas to your son and daughter in the diaspora.

One’s age, social status, political affiliation, location, employment and health condition do not hinder them from being covered on a Nyaradzo policy.

We have simplified the insurance product to the point where these factors have minimal effect even on the premium, if any.

VM: What is your opinion on the state of the insurance industry in Zimbabwe?

PM: We are pleased with the gradual increase in insurance penetration rates in the country, which are largely driven by the uptake of funeral assurance products, as reported in the recent (Insurance and Pensions Commission) IPEC report.

We are also happy that the growth is playing a part in supporting the government's National Financial Inclusion Strategy 2.

However, we believe that more can be done to support the funeral assurance sector, which is the backbone of the insurance industry in Zimbabwe. We urge the government to create incentives to spur the sector's growth.

The funeral assurance and services model as currently constituted has been tried and tested through two periods of hyperinflation and the worst global pandemic in a century; it needs not only to be protected, it must be supported because it represents the future of the insurance industry as a whole.

VM: Some people are calling for changes in the industry regulations,especially when it comes to lapses. What is your view?

PM: The raising of this point shows that a good number of people don't take time to read terms and conditions of contracts, which is quite unfortunate.

Policy lapse periods are fully addressed in Schedule 60 of the Insurance Act of Zimbabwe.

In the Nyaradzo context, we include this schedule as part of the policy document.

In response to the feedback we got, we plan on taking an industry-wide initiative to educate policyholders about their rights and obligations once they sign up for an insurance policy.

VM: Nyaradzo continues to be the biggest contributor to foreign exchange earnings according to the recent IPEC report, why is this so?

PM: We are really about listening, understanding and providing solutions.

As you know, a good number of Zimbabweans are out in the diaspora.

Instead of sitting in a corner mourning the loss of talent and skills the country has been experiencing, we saw it as an opportunity and designed a product that meets our diaspora-based compatriots' expectations.

The IPEC report you are referring to is evidence of how they have embraced the product.

We introduced the Sahwira International Plan, (SIP) which provides them with funeral cover anywhere they may be on the globe.

The product's benefits include repatriation of the deceased for burial at home, an option to have two return air tickets, a two-bedroomed apartment, and a double cab vehicle, both for up to seven days.

We have the largest share of this diaspora market, so it stands to reason that we are also the biggest contributor to foreign exchange earnings in premium income.

VM: On customer service issues, are you happy with your level of service provision?

PM: We have made it possible for our customers to give us feedback at any time through various channels.

We can't say we have reached our destination in customer satisfaction as customer needs continue to evolve.

Because we have the customer feedback loop, we will continue to improve on anything they give us guidance and feedback on.

Having said that, our customer satisfaction index is very high as evidenced by the record low levels of customer complaints and policy lapse rate as reported in the recent IPEC report.

We, however, will not rest on our laurels and will continue to invest resources and time into customer service because our goal is to always go above and beyond.

VM: What are your plans going forward?

PM: We look forward to increasing our global footprint and growing the business locally by leveraging the current composite life office model we have pioneered and perfected.

We also have a number of new and innovative products in the works, that can only be supported by the composite life office structure we have currently.

We are excited and can’t wait to share them with our Sahwira family.