GOVERNMENT has been urged to review or scrap value-added tax (VAT) on assistive devices and accessories for people with disabilities (PWDs) such as wheelchairs.

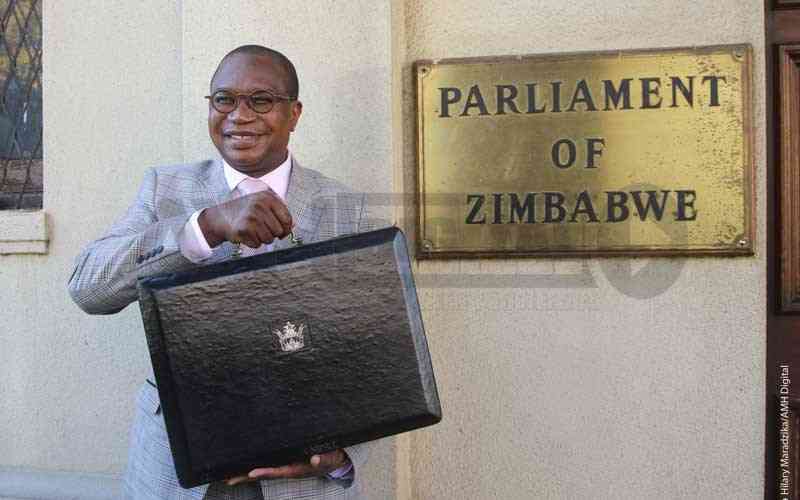

Finance, Economic Development and Investment Promotion minister Mthuli Ncube introduced taxes and duties last month, pushing up the cost of goods and services as well as assistive devices for PWDs.

Representative organisations said PWDs need support by reducing the financial burden they shoulder when they purchase the much-needed assistive devices.

The devices include a range of tools such as wheelchairs, hearing aids, crutches, white canes, glasses and low vision aids.

They vary from simple to advanced, motorised to sophisticated communication devices.

Zimbabwe Blind Women Trust director Jules Daudi said the VAT on assistive devices should be scrapped.

“It is actually a setback on the work, on the adverse case work that has been done over years. Advocates in Zimbabwe argue for freedom of movement and community inclusion, highlighting the impact of taxing assistive devices on people with disabilities who were previously confined to their homes way back,” Daudi told NewsDay.

“Disabled individuals face discrimination due to the high economic cost of disability, including assistance and even the cost of the wheelchair itself, which can double or triple the cost of travel and device purchases.”

- Budget dampens workers’ hopes

- Govt issues $24 billion Covid-19 guarantees

- Letter to my People:They have no answers for Nero’s charisma

- ZMX to enhance farm profitability

Keep Reading

She said the country’s commitment to ensuring social security for PWDs was questionable.

“If we are saying everything that concerns their rights is subject to availability of resources, then it means as a country, we are not committing,” she said.

“If you look at the 2024 budget and the budget three years back, even up to 2021, we have been falling short of the social security target that we have set ourselves through the legislation of the country and the international legislation.”

Daudi also complained that the National Disability Policy on proposed disability levies had not been implemented.

“We have fallen short by more than 3% of the social security commitment, which means that even the charity that was giving persons with disabilities through social welfare is falling short. So we are not doing enough for people with disabilities,” she said.

“The current resource commitment is falling short, and it is recommended to eliminate value-added taxes.”

Signs of Hope Trust director Samantha Sibanda said assistive devices were essential for PWDs.

“The ministry’s introduction of VAT on important devices and equipment for persons with disabilities is reversing the National Disability Policy principles and constitutional rights of disabled individuals so we call for its removal,” Sibanda said.

“Section 83 (and) Section 22 of the Constitution provides constitutional support for persons with disabilities for advancement, but taxes may reduce their participation.

“This is actually a reversal of the constitutional provisions and it is actually shooting us in the foot on behalf of the government given the constitutional provisions of the National Disability Policy.”

According to the World Health Organisation Global Report on Health and Equity for Persons with Disabilities released recently, the provision of assistive devices is a key facilitator for access to health services by people with disabilities.