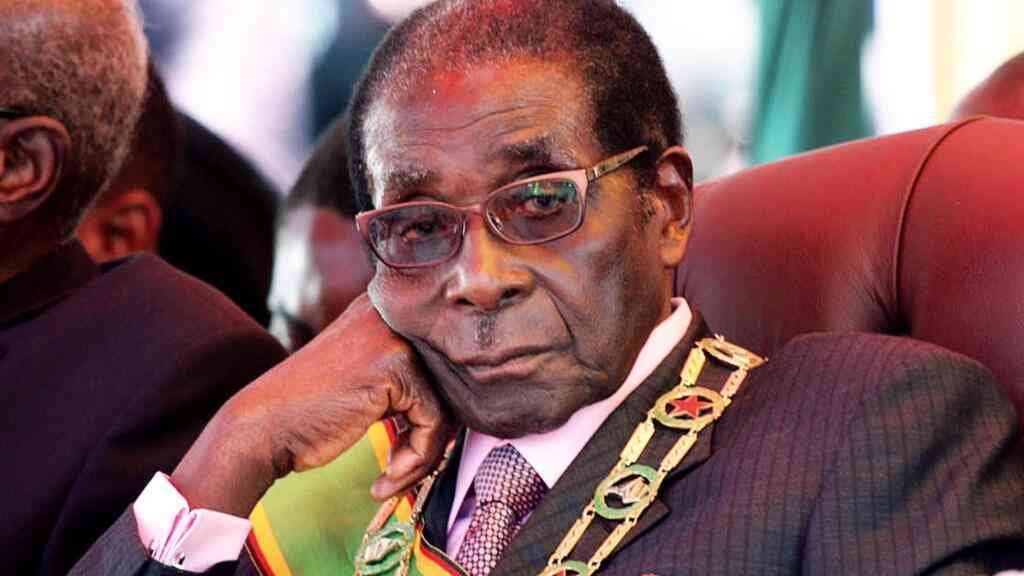

PRESIDENT Emmerson Mnangagwa recently threw a cat among the pigeons. He reignited debate on the currency issue, causing confusion on the market by suggesting that he will soon give a directive for the sole use of Zimbabwe Gold (ZiG).

Zimbabwe has battled currency instability over the years. One of the reasons for this is policy inconsistency.

Now, Mnangagwa has hinted that he wants a mono-currency before 2030, despite a Statutory Instrument (SI) stating otherwise. He said the country could not continue to rely on other countries’ currencies.

In April this year, the Reserve Bank of Zimbabwe (RBZ) introduced ZiG “to stabilise the economy”.

“In two years, in fact two years is too far off, but there will come a time when our ZiG currency has fully penetrated the market, then I will give a directive that the country will be using the ZiG only,” Mnangagwa said.

“Even those who were performing and entertaining us today, who were being given US dollar tokens, in two months’ time you (they) will be given the ZiG and no US dollars because that is our currency and we should propel it.”

The government in October 2023 gazetted SI 218 of 2023, which extended the use of the multiple-currency system to December 2030 — putting to rest the anxiety by businesses and potential investors over the currency debate.

This inconsistency is causing jitters in the market, creating uncertainty among businesses, investors, banks and the general populace.

- So, is it a currency?

- Navigating Zim’s new monetary frontier: A profound analysis and real estate implications

- New RBZ boss talks tough

- Letter to my People: Exit Panonetsa, enter John II and the ZiGy Zag band

Keep Reading

Policy inconsistency has been a long-standing issue in Zimbabwe, and this recent declaration only exacerbates the problem. Investors, already wary of the economic environment, are now even more hesitant to commit resources.

The banking sector is similarly affected with some banks holding back on lending in foreign currency. Ordinary Zimbabweans are also worried about the safety of their foreign currency bank balances.

While we understand the necessity of eventually transitioning to a mono-currency system, the process must be managed with extreme caution.

Confidence in the new currency is paramount, and the groundwork must be laid before any significant changes.

Key economic fundamentals, such as a stable ZiG currency, strong foreign reserves, adequate import cover, low inflation, consistent economic growth, and robust economic policies, must be in place to ensure stability.

The foreign reserves, which stood at US$285 million when the currency was launched, now exceed US$380 million, which is still very low.

We need to develop at least three months of import cover, which amounts to about US$2,2 billion in terms of foreign exchange reserves.

Our neighbouring countries - Zambia and Botswana — are averaging about US$5 billion foreign exchange reserves, while South Africa is around US$62 billion.

There must be clear, consistent communication regarding any policy changes to avoid market turmoil.

Zimbabwe is not the first country to face challenges of de-dollarisation. Countries like Cambodia, Bolivia, Vietnam, Peru, El Salvador and Chile have also attempted to de-dollarise, with varying degrees of success.

Israel is one of the few countries that successfully managed to de-dollarise due to a combination of free-market policies, stable domestic money supply, macro-economic stability and strong institutions.

These experiences suggest that de-dollarisation should be a gradual process, supported by comprehensive economic reforms and robust institutional frameworks, as oftentimes it has led to capital flight and a financial crisis.

Currently, the US dollar is used in more than 80% of transactions in Zimbabwe, providing a semblance of stability in a historically volatile economic environment.

The RBZ has indicated a gradual shift towards reducing this reliance, aiming for a 70:30 ratio by year-end or 60:40 thereafter, until the market is indifferent to the currency in use.

However, the President’s sudden statements have rekindled the debate on de-dollarisation and undermined confidence. Such statements, particularly when they contradict existing policy frameworks, create confusion and uncertainty.

To avoid repeating history, it is crucial that any move towards de-dollarisation is conducted transparently, with clear timelines and consistent communication from the government.

While the goal of de-dollarisation is understandable and essential, it must be approached with caution and strategic planning.

The President’s recent statements have unfortunately sown confusion and uncertainty, which could have been avoided.

It is essential that the government reassures the market by demonstrating commitment to a clear, consistent and well-communicated economic strategy.