The transition from the Zimbabwe dollar to the Zimbabwe Gold (ZiG) presents significant challenges for accountants.

First, the rapid devaluation of the ZiG has created complexities in financial reporting, as companies must frequently adjust valuations to reflect changing exchange rates.

This instability complicates budgeting and forecasting, making it difficult to project future financial performance accurately.

Additionally, the lack of trust in the new currency exacerbates these challenges.

Accountants must navigate a landscape where clients may prefer to conduct transactions in foreign currencies, leading to discrepancies in financial records.

The shift also complicates compliance with tax regulations, as accountants must stay updated on new tax implications associated with currency changes.

Many accountants may struggle with the practical implications of converting historical financial data into the new currency, raising concerns about the accuracy and reliability of financial statements.

Last month Johannesburg Stock Exchange-listed entity, Old Mutual Limited, said it had excluded Zimbabwe’s adjusted headline earnings from its interim financials due to hyperinflationary pressures and difficulties in remitting dividends.

- Caledonia lays out Bilboes revival plan

- Letter from America: Gold Mafia: Zim government should rethink its policies!

- So, is it a currency?

- Will gold tokenisation work?

Keep Reading

Adjusted headline earnings calculations is a key financial metric used to measure profitability, while providing a more normalised view of a company’s performance which allows investors and analysts to make more accurate comparisons with other companies.

Zimbabwe is going through a series of financial woes exacerbated by high inflation as the currency dynamics keep shifting.

On the other hand, the decade-long challenges around currencies have also made it difficult to remit dividends out of the country.

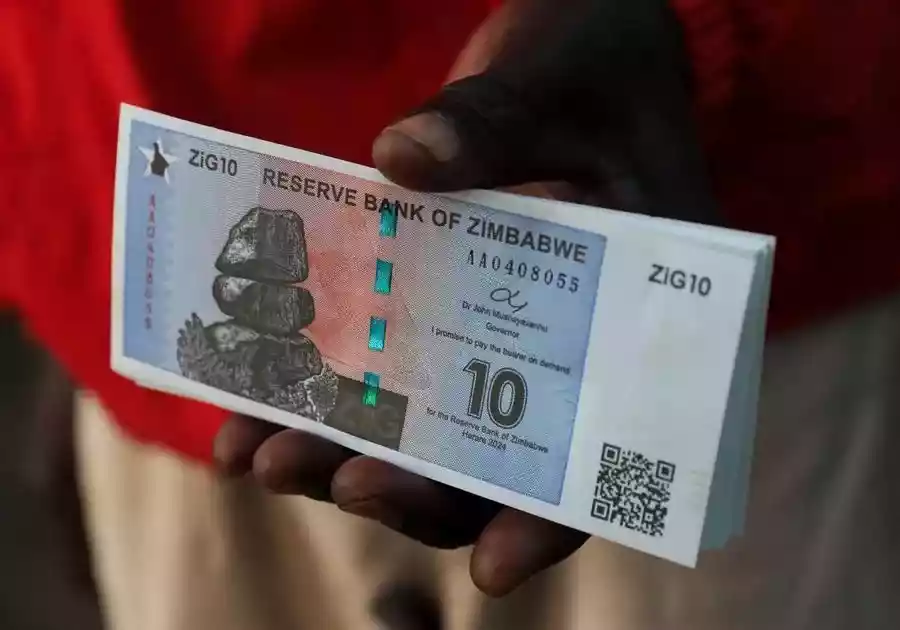

Six months ago, the Reserve Bank of Zimbabwe (RBZ) introduced the Zimbabwe Gold (ZiG), a currency intended to stabilise the economy and restore confidence among a populace weary from years of hyperinflation and economic turmoil.

Touted as a solution backed by gold and foreign exchange reserves, the ZiG promised to mitigate the rampant depreciation that has long plagued the Zimbabwean dollar.

However, recent developments reveal a different story: the currency has faced significant pressure, culminating in a shocking 43% devaluation just last month.

It is time to reassess this ill-fated experiment and consider abandoning the ZiG altogether.

Just after the release of the new currency human rights activists said tthe ZiG was imposed on us, meaning that the government never bothered to consult ordinary people about it.

The hasty introduction of the new Zimbabwe Gold (ZiG) currency without thoroughly consulting ordinary people is the latest sign that the government is keen to undermine the country’s Constitution, Zimbabwe Human Rights Association (ZimRights) director Dzikamai Bere said, in an interview with the NewsDay in the past weeks.

Speaking during an interview with the Crisis in Zimbabwe Coalition (CiZC), which shared the conversation with NewsDay, Bere said the constitution gave Zimbabweans the power to determine the way they are governed.

Citing the new currency, Bere said: “A new currency is not a tsunami. You know, as a government, that you are going to introduce a new currency on this day, so you should begin a process of consulting the stakeholders.

“You bring the law to Parliament, to allow Parliament to debate the law. Because sovereignty resides in the people, you do not ambush people with a new currency.”

The ZiG replaced the Zimdollar, which had been heavily battered by inflation, resulting in the economy self-dollarising.

Authorities insist the ZiG is backed by gold and foreign currency reserves as well as other minerals.

However, Bere said people must be consulted first in line with dictates of the constitution.

“This is why the constitution starts with the phrase ‘we, the people’, and establishes what we call the sovereignty of the people,” he said.

Last week businesses leaders said they wanted the ZiG to be scrapped owing to its volatility despite the central bank’s insistence that the six-month-old currency is here to stay.

Speaking at the CEO Africa Roundtable (CEO ART) currency review breakfast meeting in Harare this past week, CEO ART chairperson Oswell Binha said the ZiG had become a tool for arbitrage, causing more harm than good to the economy.

Binha said the ZiG faced the same fate as its predecessors, the Zimbabwe dollar, RTGS dollar and bond notes, which were eventually scrapped.

“So, (Reserve Bank of Zimbabwe) deputy governor (Innocent Matshe), let me start by provoking this conversation by calling for an immediate removal of the ZiG from the basket of currencies and allowing for the trading of other currencies until we get to such a time when we decide to have a stable currency,” Binha said.

“We need to have time to have these serious conversations of a currency referendum involving everybody to navigate and decide which currency to use.

“I think it is time that all economic players be given the opportunity to be involved and be able to make the right choices.”

The local currency that authorities say is backed by gold and forex reserves, has been under pressure in the past two months, taking a beating against the United States dollar on the parallel market.

RBZ was last month forced to devalue the ZiG by 43% to 24,39 per dollar as part of measures to allow greater exchange rate flexibility in line with increased demand for foreign currency in the economy.

The local currency is on shaky ground and requires authorities to take urgent measures to arrest collapse.

There are indications that the structured currency, introduced amid pomp and fanfare, is one foot into the grave.

The ZiG is crumbling like a colossus with feet of clay.

Zimbabwe has been experimenting with currencies after the initial scrapping of the Zimbabwe dollar in 2009 due to hyperinflation, with the ZiG being the country’s sixth attempt to introduce a stable currency.

*Gary Gerald Mtombeni is a journalist based in Harare. He writes here in his own personal capacity. For feedback email garymtombeni@gmail.com/ call- +263778861608