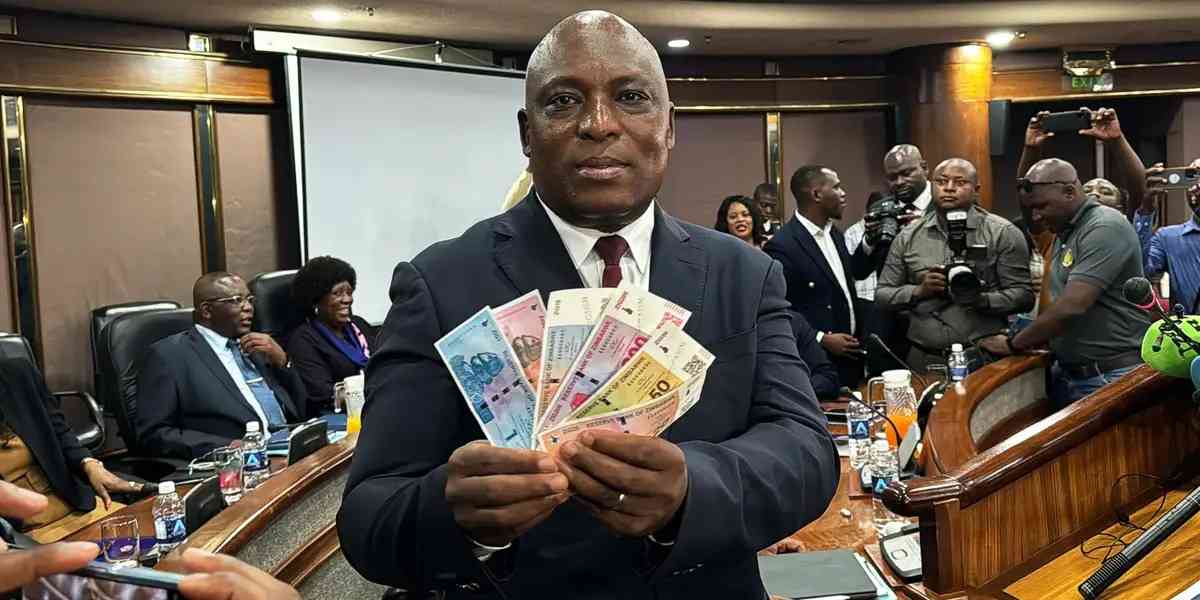

The new Zimbabwe Gold (ZiG) notes and coins will begin circulation today, nearly three weeks after Reserve Bank of Zimbabwe (RBZ) governor John Mushayavanhu announced the introduction of the structured currency to replace the Zimdollar.

The rollout of the ZiG notes and coins will “bury” the Zimdollar, five years after the currency was reintroduced.

Until the introduction of ZiG, the Zimdollar, which was resuscitated after having been abandoned at the onset of a multi-currency regime in 2009, had been on its way to the grave with more than eight out of 10 transactions carried out in United States dollars.

It had also lost its functions as a store of value and medium of exchange.

While RBZ said the Zimdollar would work alongside ZiG until April 30, the former "ceased" to be legal tender in the informal market the day Mushayavanhu announced the introduction of a structured currency on April 5.

Save for established retailers, the currency had been "banished" from circulation in the informal sector and commuter omnibuses where it was used mainly as change.

The ZiG notes and coins were supposed to start circulating on April 8, but their introduction was pushed back to April 30 to allow the central bank to “undertake an intensive educational and awareness campaign on the key security features of the ZiG notes and coins”.

ZiG notes and coins to be introduced into circulation are in denominations of of 1ZiG, 2ZiG, 5ZiG, 10ZiG, 20ZiG, 50ZiG, 100ZiG and 200ZiG.

- Mayhem as schools reject Zimdollar fees

- Forex demand continues to fall

- USD fees: Govt policy failure hurting parents

- Zimdollar shortage hits the country

Keep Reading

RBZ had three weeks to put its house in order and the failure to smoothly roll out the ZiG notes and coins will have disastrous consequences.

The market had "weathered" the storm in the past three weeks with the informal sector and commuter omnibus crews improvising to come up with change.

Any further delay will reverse the appetite for ZiG.

The notes and coins should be readily available today in banks so that they begin circulating in the economy.

It has been more than three weeks of waiting for the commuting public that was being forced to pay US$1 where US$0,50 would have done the trick due to the abscence of change.

RBZ must have systems in place which will not allow the notes to flood the streets.

While it has stipulated withdrawal limits, the apex bank must ensure that banks adhere to them. Banks that violate the set rules must be hauled over the coals.

The market has been patient, giving Mushayavanhu a chance to put in place appropriate measures.

ZiG has gained confidence among the public and business with two airlines announcing the sale of their tickets in the new currency.

It points to a rosy outlook and monetary authorities must capitalise on this unexpected goodwill.

Will Mushayavanhu get it right this time around after a false start or he will bottle it?

The coming weeks will make or break Mushayavanhu’s plans.