In an era where global investment opportunities are more accessible than ever, Zimbabweans with an eye for financial growth are increasingly turning their gaze towards the United States(US) stock market.

Known for its depth, liquidity, and the potential for substantial returns, the US market offers a promising avenue for investors looking to diversify beyond local boundaries.

However, this venture into international waters requires not just capital, but a keen understanding of brokerage choices, tax implications, and strategic investment planning to navigate through the complexities effectively. Here are some insights on how to invest in the US markets.

1)Choosing a brokerage account

When selecting a brokerage for investing in US stocks from Zimbabwe or elsewhere, consider the following:

a)Fees: Look for brokers that offer low or no commission on trades, which supports trading in US stocks with competitive fees. Google should be your friend to research the best that suits your investment strategy.

b)Currency handling: Since Zimbabwe uses a multi-currency system with significant reliance on the US dollar, brokers that facilitate easy currency conversion or allow transactions in USD can be beneficial.

c)Regulation and security: Ensure your brokerage is regulated by respected financial authorities. This provides a level of security against fraud. In Canada where I reside, the brokerage accounts I use for my investing and trading have insurance for clients to get back up to a million dollars back, should the brokerage go bankrupt.

- Education crisis mirrors national problem

- USD fees: Govt policy failure hurting parents

- Zim has 2nd highest rising food prices: WB

- US raises red flag on abuse of journos in Zim

Keep Reading

d)Platform features: Features like real-time market data, research tools, and educational resources can enhance your investment decisions.In my case, my Canadian broker allows me features I use for my trading such as real time data and I also use additional platforms such as Trading view for my technical analysis. There are free and paid versions and depending on the depth of your pocket, you choose what works for you.

2) Understanding tax implications

a)Dividend tax: As a non-resident citizen, you are subjected to a 30% dividend withholding tax by the Internal Revenue Services (IRS), unless reduced by a tax treaty. Zimbabwe currently doesn't have such a treaty with the US.

b)Capital gains: There's no capital gains tax on US stocks for non-residents not physically present in the US, simplifying tax considerations.

c)Local taxes: Always check for any local tax implications in Zimbabwe; while there's currently no capital gains tax, future policy changes could affect this. Consult with licensed tax advisors on how to legally avoid taxes. I have noticed that most people who contact me to learn about investing in the US and Canadian markets seem not interested in paying for consultation. It is important to understand that consulting experts have been shown to save more money in the long term. Experts charge for their time, and if you can not pay consultation fee, I encourage you to take time to research and learn on your own.

3) Investment strategies for Zimbabwean investors

- a) Diversification: Investing in broad market indices like the S&P 500 through ETFs (like VOO or SPY) reduces risk by exposing you to a large segment of the US economy. Note, this is not investment advice or recommendation. You must always do your own research or consult financial advisors.

- b) Growth vs income: Decide if you're looking for capital growth or regular income (dividends). US tech giants might offer growth, while utilities or consumer goods might provide steady dividends.

c)Economic hedging: Given Zimbabwe's economic volatility, consider a diversified approach:

- i) US Stocks: For growth potential.

- ii) Gold: Historically, gold acts as a hedge against inflation and currency devaluation.

iii) Bonds: US Treasury bonds or bond ETFs can provide stability and income, balancing the riskier equity investments.

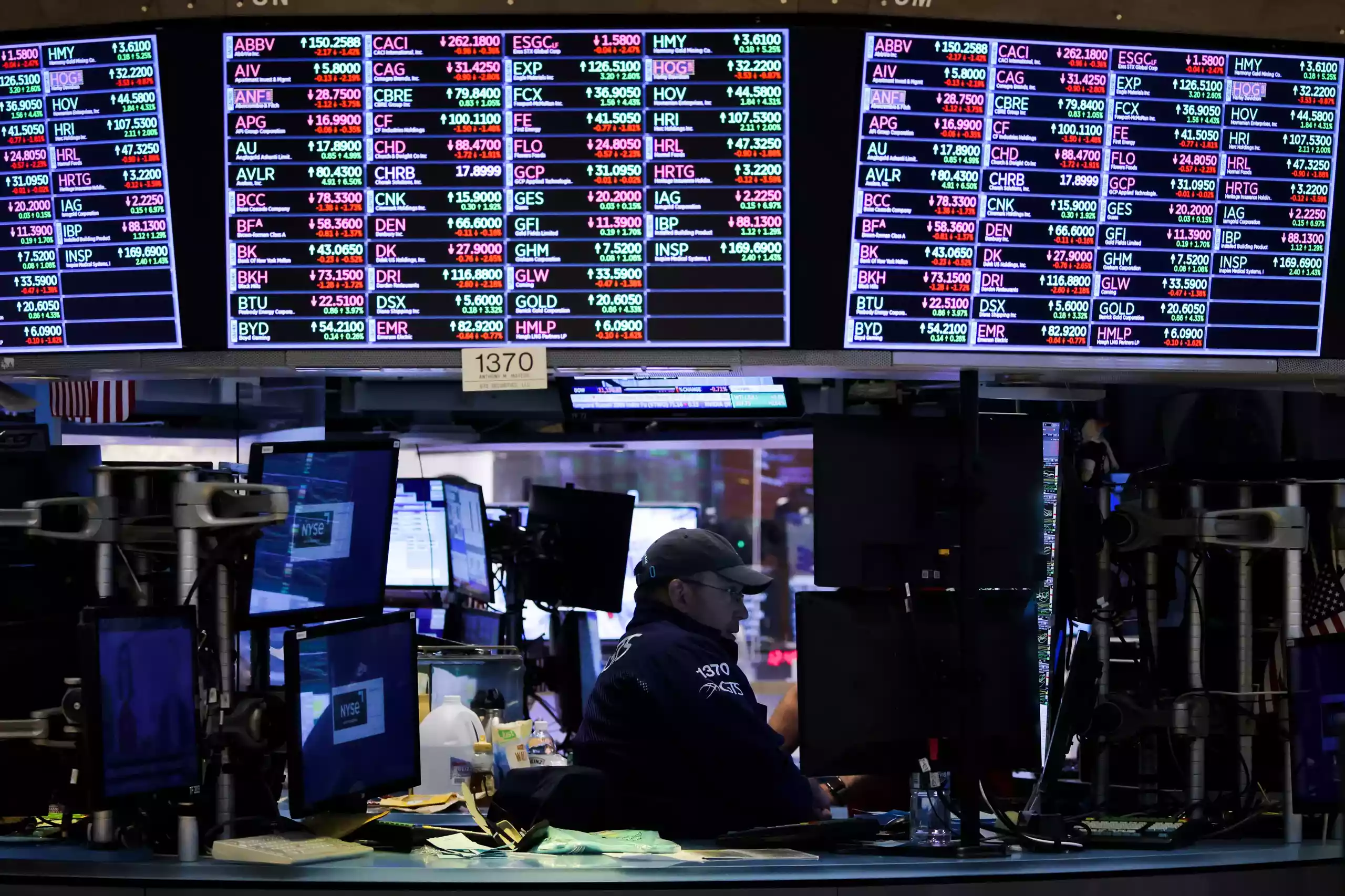

4) Recent performance of US markets

a)S&P 500 (SPX): Historically provides solid long-term returns, though subject to market cycles. Year to Date (YTD) SPX has been up 24%. It doesn't go up every year but historically on average it has returned 10% a year excluding dividends.

- b) Nasdaq Composite (IXIC): Dominated by technology companies, has shown significant growth but with higher volatility. YTD, IXIC is up 26% representing a good run this year.

- c) Dow Jones Industrial Average (DJI): Reflects the health of large-cap US companies, traditionally less volatile than Nasdaq. YTD, DJI is up 14% which is not bad compared to most investments worldwide.

To invest into these indices, I invest through a selected Exchange traded Fund (ETFs) which replicate the composition of these indices.I have devoted some time explaining a lot of these ETFs on my YouTube channel at Streetwise Economics. You can consider watching those and learn about their fees and past performance.

5) Limiting risk

To limit risk as a trader, I use some of these tools.

- a) Stop-loss orders: Set to sell assets if they fall to a certain price, limiting loss.

- b) Asset Allocation: Regularly rebalance your portfolio to maintain desired risk levels. I review and rebalance my portfolio at least twice a year.

- c) Education: Continuous learning about market trends, company fundamentals, and economic indicators is crucial. Alternatively, pay an expert to invest and manage your portfolio.It is very important to check their past record at least and credibility and qualifications. Most funds I know are closed funds only accepting money in millions mostly through referrals. As a retail investor, the edge is in being able to manage your own portfolio if you have the skills to do so..

- d) Emergency fund: Keep some investments liquid or in low-risk assets like money market funds for liquidity. As a rule of thumb from financial experts, 6-12 months worth of cash can be helpful.I prefer having cash more than cash needs for at least a year. This can come handy if you lose your job or income stream(s) unexpectedly.

Investing in the US market from Zimbabwe involves navigating through brokerage choices, understanding tax environments, and strategically planning your investments.

By focusing on diversification, understanding market trends, and employing risk management, Zimbabwean investors can potentially grow and protect their capital in one of the world's most robust financial markets.

*Isaac Jonas is a Canadian based economist and consultant at Streetwise Economics. He is also a retail investor and retail trader, focusing mainly on the US and Canadian capital markets. He regularly shares insights via his social media handles. His website is www.streetwiseeconomics.com and can be reachable on isacjonasi@gmail.com. Insights shared in this article do not amount to investment advice.